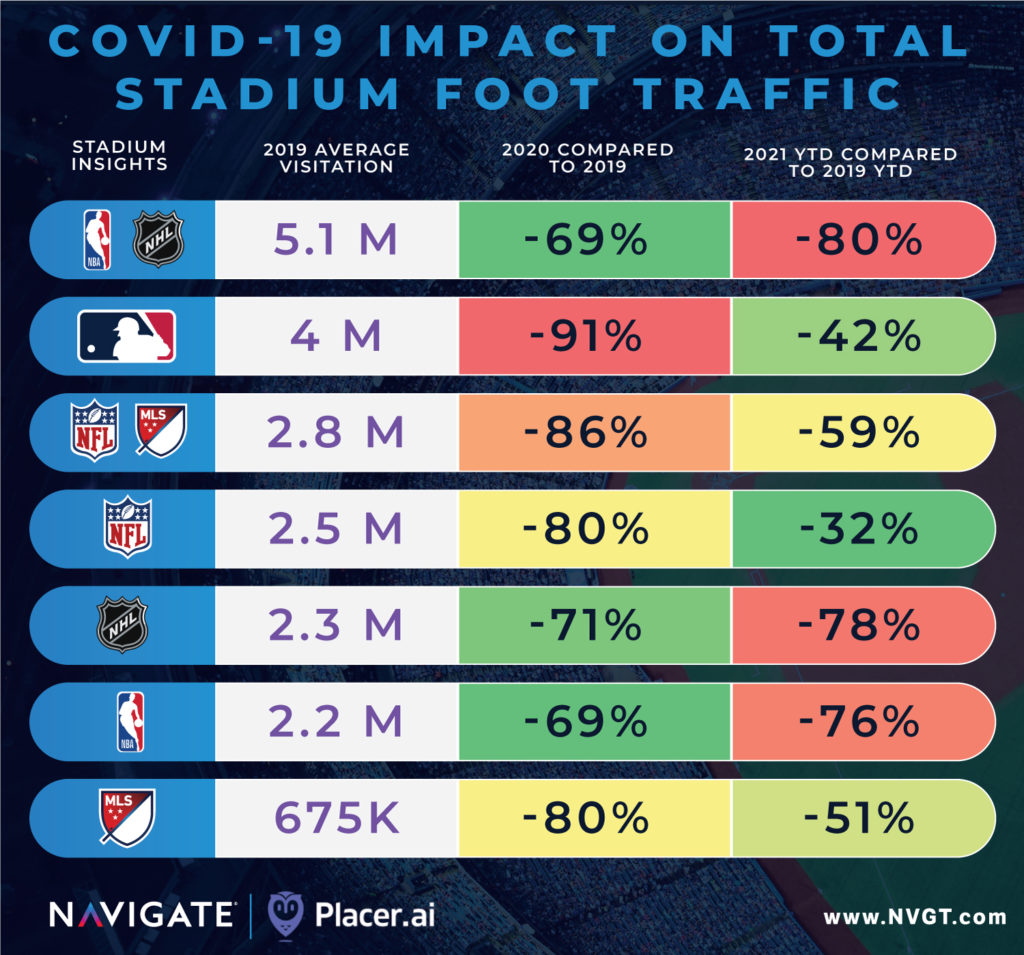

A Comprehensive Picture of Annual Stadium Visitation and COVID-19 Recovery Trends

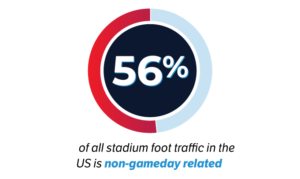

The Coronavirus epidemic has changed the sports landscape significantly. On March 11th, the first domino fell when the NBA suspended the 2019-20 season with meaningful basketball not returning for another 141 days. The majority of sports events in 2020 were played in front of diminished capacities or no fans at all. It’s fairly easy to look at box scores from last season and realize the effect on attendance – but stadiums schedule other programming that can be considerable revenue drivers for these buildings. Concert tours cancelled, secondary events and stadium tours postponed indefinitely, parking lots and non-gameday retail sections empty – the impact can be seen beyond each team’s respective competitive schedules. While attendance certainly provides insights into trends in visitation, regular season ticket buyers make up only 44% of traffic to all stadiums on an annual basis. Navigate dove into one of our newest resources, Placer.ai, to calculate a comprehensive impact analysis of every pro stadium in the nation.

Placer.ai analyzes foot traffic and also creates consumer profiles to help clients make marketing and ad spending decisions. It does this by collecting geolocation and proximity data from devices that are enabled to share that information. Placer.ai gathers anonymized data from tens of millions of devices to help clients understand visitation patterns. Any panelist who spends more than 7 minutes in a given POI’s parameters is tracked towards visitation metrics. Placer.ai provides a more accurate picture of a stadium’s patrons compared to ticket sales. The platform matches Census Block Group data to the panelist’s home location to provide demographic insights of actual visitors to the property – an issue that has challenged team marketing departments due to the popularity of the secondary ticket market.

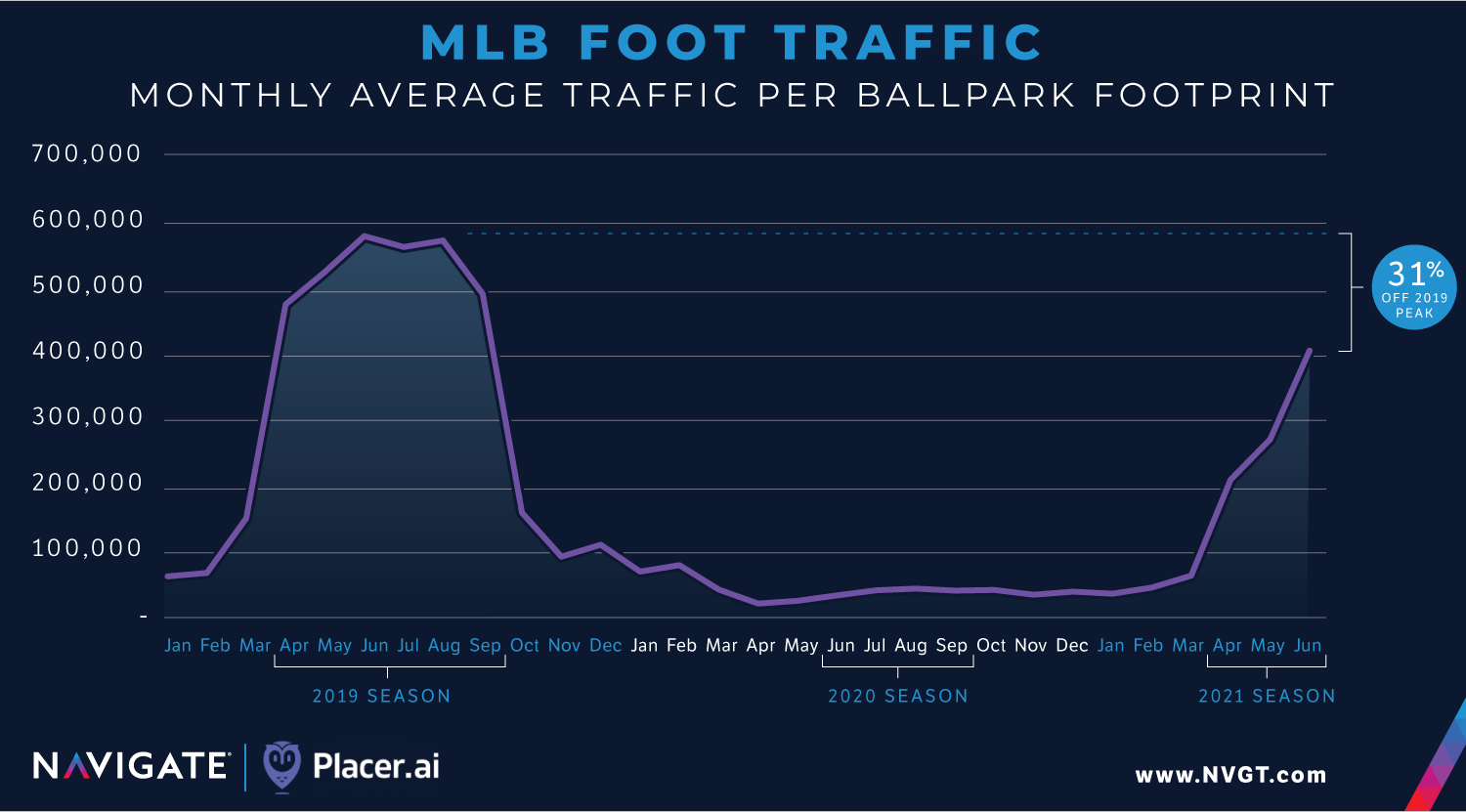

Comparing sports on a calendar year basis, MLB was hit the hardest with a -91% drop in visitorship to its stadiums compared to 2019, however in 2021 they are recovering at a faster pace than most sports, with every single US ballpark operating at maximum capacity as of the date of this publication.

Schedule timing and how they coincide with public-gathering restrictions have had the most profound effect on visitation data. In 2020, the NBA and NHL had already completed the majority of their respective seasons before the global crisis was declared, however, they have already completed their 2021 seasons with virtually no in-stadium attendance. The timing of the national vaccine rollout combined with harsher restrictions on indoor mass gatherings have led to 2021 likely having a more severe visitation impact compared to 2020, when the year is complete.

The NFL season was able to start on-time, after severe coronavirus lockdown restrictions had been lifted and diminished capacities were allowed by state and municipal governments. Even though the NFL lost a considerable amount of attendance from early year playoff games compared to 2019, it seems their stadiums have found alternative ways to generate eyeballs, possibly attributable to their announcement that all 30 stadiums would be used as mass vaccination sites earlier this year.

We will continue to keep a pulse on these trends and provide an end of year update to see how stadiums recover over the 2nd half of 2021.

Feature image disclaimer: Conditional format coloring based off relationship to average impact among all sports properties.