COVID-19’s Impact and the Future of Sports Revenue

The total monetary impact from COVID-19 on sports in the United States has yet to be settled. However, it is estimated that close to $30 billion in revenue and hundreds of thousands of jobs will be lost in 2020 due to the pandemic. Suppliers (e.g. athlete travel and accommodation), buyers (e.g. media and sponsors), and indirect beneficiaries (e.g. bars and restaurants) have all felt the effects.

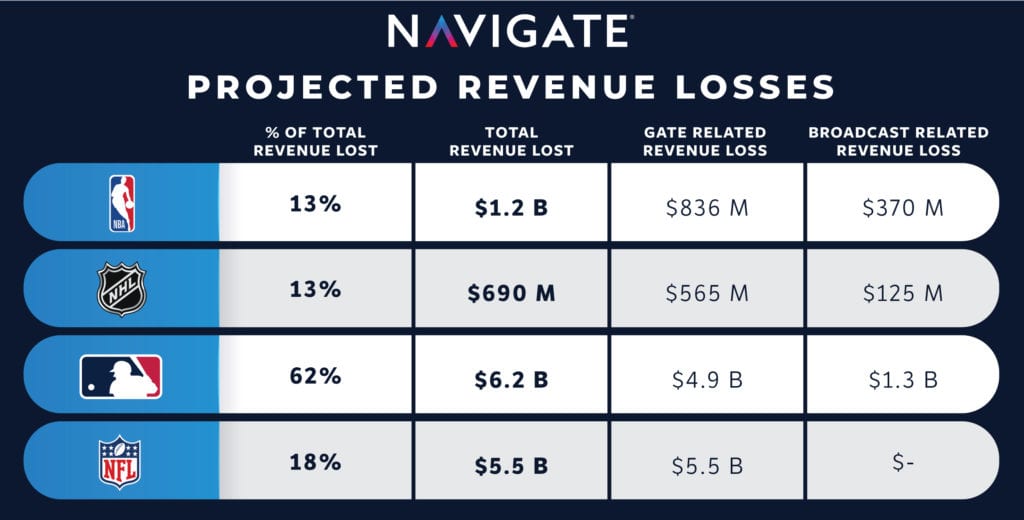

Navigate took a deep dive into the direct loss to the four major sports leagues. Some elements of revenue loss are easier to identify than others. We looked at a few separate buckets to try to quantify the loss realized and projected for the four major sports leagues.

Both the NBA and NHL completed most of their regular seasons, and are successfully conducting their playoffs in their respective bubbles. Major League Baseball has not been so fortunate. The loss of over 60% of their season hurts a property that relies on gate related revenue more than any other league. They plan to fulfill their broadcast obligations and mitigate the loss of regular season revenue via an expanded playoff structure. For the NFL, loss calculations were based off of each team’s current publicly stated capacity thresholds (~6% of total league wide capacity at the moment), but gate-related losses may not be as significant if COVID-19 cases subside moving into fall and winter and capacity restrictions are alleviated.

What does it mean for the future of sports revenue?

Although COVID-19 has decimated the live element of watching sports, it hasn’t impacted the importance of brand association with top tier leagues and properties. Ad spend devoted towards sports publishers dropped by a modest (all things considered) 31% between March and July, and has returned steadily as leagues have reopened their doors. According to MediaRadar, 83 of the top 100 sports advertising spenders pre-pandemic continued spending during the official first month of sports’ “return to play”. Only 5 of the top 50 spenders completely froze their sports broadcast advertising budget.

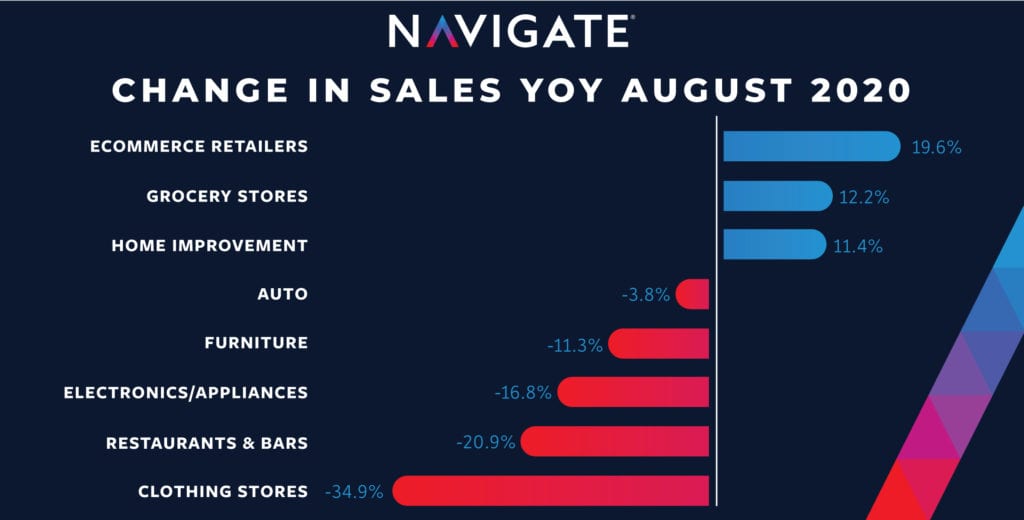

The sudden shift in consumer behavior over the past 7 months has also changed industry narratives. Financial services, alcohol brands and service-centric businesses have grown their share of total spend, while technology, media and apparel all saw a decrease – with travel and accommodations companies dropping to virtually zero spend. This is mirrored in changes at the check-out (see figure below), as consumer behavior shifts heavily towards online shopping, with brand choices driven by value, availability, and convenience.

Properties must not only be prepared for changes in category viability, but also changes in marketing channel spends that will alter budget allocations. The Interactive Advertising Bureau’s latest COVID-19 impact survey shows an expected YoY spend decline of 24% in linear TV, 46% in out-of-home (OOH) and 31% in radio. On the other end of the spectrum, connected TV is expected to grow by 19%, while digital video and social media will see 18% and 25% increases, respectively. Properties must anticipate which of these channel shifts are here for good and adapt with attractive and scalable inventory creations.

Sports being a mass consumer passion point will not change in the long run, but this “new normal” will certainly minimize the reliance on gate related revenues, and instead, emphasize the need for alternative revenue streams and creative commercial partnerships.

Three positives to come out of this situation:

- The creation of new, highly attractive sponsorship inventory. Not only those designed specifically for broadcast viewers, but also replicable activations that bring the tangible experience of live sports home to fans (Think: Stadium-in-a-box and tailgate subscription packages)

- The catalyst for 5G adoption and alternative ways to experience the thrills of sports outside of the stadium (VR and more engaging OTT content)

- As difficult as the pandemic has been, one silver lining is that it will accelerate the pace of change and bring the future of sports partnerships sooner. For proactive brands and properties this means using this time to reset partnership objectives and align on mutually beneficial objectives moving forward.