Forever Faster – Puma, the fastest sports brand in the world

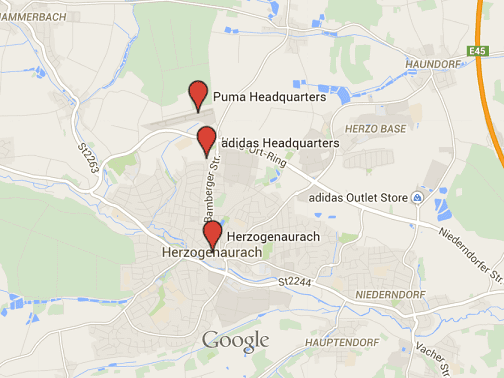

As a youth player, young coach and semi-professional in Germany in the 1970s, I knew of only two soccer brands one should wear on one’s feet: Adidas and Puma. If you think that’s limiting, consider that I only had one choice of color: black (decorated with either the three Adidas stripes or the Puma form stripe). I was always keenly aware of the history between these two German soccer brands – perhaps because I grew up with three soccer-playing brothers. Adi and Rudi Dassler were brothers and partners in their shoe company Gebrüder Dassler Schuhfabrik. They became rivals in 1948, founding Adidas and Puma, respectively. Ever since I was a child I have found this history fascinating. To this day, both companies are still headquartered in the same small town near Nuremberg in southern Germany (Herzogenaurach).

I didn’t pay any attention to Nike cleats until the 1990s. But sometime after the mid-90s, or later, there was a turning point where I personally believed their design and technology had caught up to Puma and Adidas.

Today, consumers can choose from a multitude of brands and cleat colors. Puma was always a major player in the soccer footwear and apparel industry but has now fallen well behind giants Nike and Adidas. Adidas and Nike share over 80% of annual sales, depending on specific soccer product categories.

The high school where I now coach the women’s and men’s soccer programs uses Puma balls for both programs and kits for the men. But, how does a smaller brand, like Puma, keep pace in the global soccer market? After all, Puma is the third biggest soccer sponsor behind Nike and Adidas.

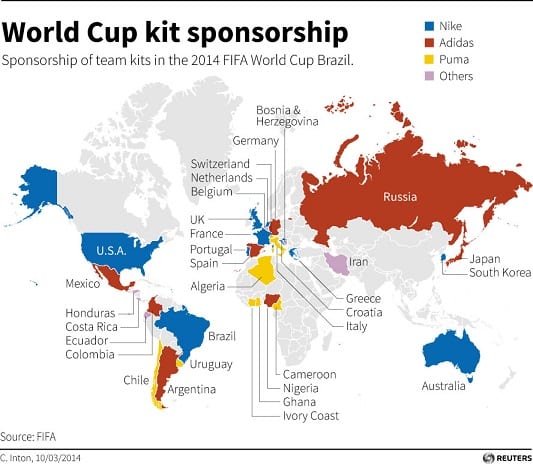

During the 2014 FIFA World Cup, Nike sponsored the jerseys of 10 of the 32 participating nations and Adidas sponsored nine. Even though Puma, with eight nations, looked like it kept pace, Nike and Adidas featured prestigious soccer nations such as Argentina and Spain (Nike) and Germany, England and Argentina (Adidas). Puma instead focused on smaller (and less expensive) national teams, such as African and smaller South American countries. (Its big gun is the Italy national team.) In addition, Adidas’ crown jewel in the soccer sponsorship world is the FIFA World Cup (and Nike runs heavy guerilla marketing campaigns around each World Cup). Puma largely refrained from participating in expensive World Cup marketing campaigns in 2014. This is hardly surprising since the most expensive event sponsorships at the World Cup in Brazil demanded fees of $75 million.

What Puma has done in the past is to define who and what they are, with a heavy focus on soccer and a differentiation on brightly colored and fashionable footwear and apparel (collaborating with major design brands such as Alexander McQueen and Mihara Yauhiro). With its Forever Faster campaign Puma is now focusing its efforts on being a sports performance brand foremost instead of a sports fashion brand (although that perception remains and may indeed still be useful). The new tag line and brand platform are intended to return Puma to its sports roots and positively impact the bottom line. According to Puma’s press release, its new campaign “embraces the thrill of being first, the swagger of being the best, and the fun of being able to adapt…It signifies the desire to quickly identify product designs and innovation, trends and style and bring them into the marketplace in a more dynamic manner.”

On September 16 of this year, Puma acquired a five percent stake in German Bundesliga club Borussia Dortmund (a club steeped in history and tradition), who continue to sport Puma jerseys. (In case you’ve always wondered, “Borussia” is Latin for Prussia.) And in one of the largest kit contracts in the world, Puma this year also landed perennial top four Barkleys Premier League club, Arsenal F.C., which boasts one of the highest selling club jerseys in the world.

Puma offers an alternative to those athletes who do not like to run with the usual crowd. (One of Puma’s major endorsers, Mario Balotelli, controversial Liverpool FC and Italy star, is certainly one such individual.) In the coming years, will Puma be able to bridge the perceived performance gap to its colossal soccer rivals and justify its relatively high stock price?