How Technology Partners are Changing the Research Landscape

At Navigate, it is our mission to provide data-based answers to our clients’ most vital business questions. We use a variety of data sources to do this, including custom primary research and a wealth of secondary data tools.

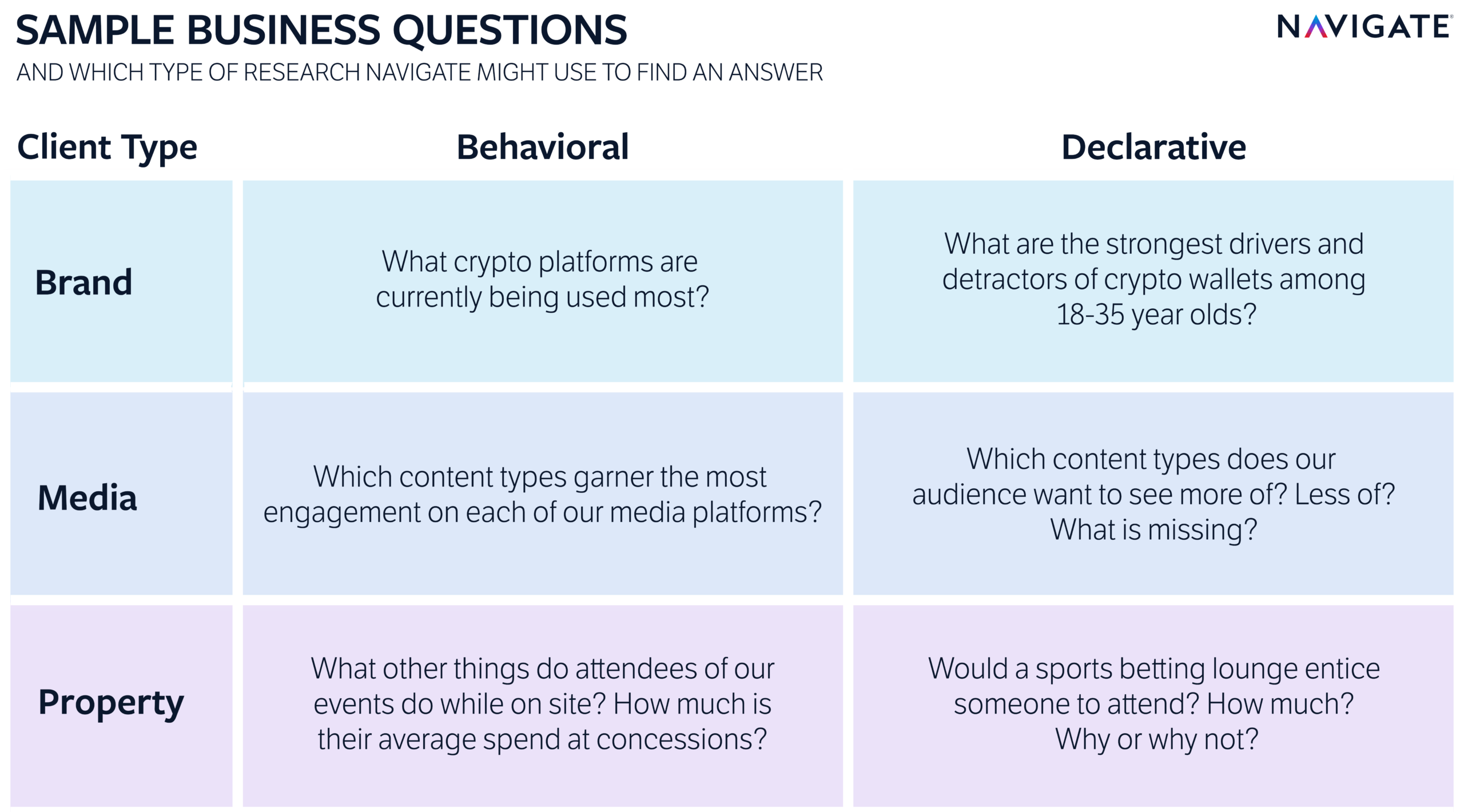

Our secondary data toolkit includes platforms that provide both declarative and behavioral data. Declarative data is derived from consumers self-reporting on their behaviors, actions, and emotions. Behavioral data is the result of monitoring people’s actions rather than their self-reporting.

With the emergence of rapidly changing technology, behavioral data has become more widely available. We have the ability to use behavioral platforms, like our partners, Helixa and Placer.ai, to access a new class of data. Combining this data with survey data, allows us to understand both the ‘what’ of certain behaviors (e.g., which sports betting platforms people are using most), as well as the ‘why’ (e.g., drivers and barriers to using various platforms). Declarative data is still key in understanding what fans think about your organization and the products or services it provides, i.e., it highlights how a consumer thinks. It has, however, become a piece of the puzzle as opposed to the only piece of an incomplete puzzle.

On a daily basis, our consultants leverage multiple data sources (including both behavioral and declarative) to inform business solutions for brands, properties, and media companies. Below are some examples of questions that we could answer with either declarative or behavioral data.

Using our behavioral research partners mentioned above, we are able to get an accurate reading of consumer sentiments surrounding the biggest challenges in our industry. For a detailed breakdown of one of the ways we use Placer.ai, check out this blog post we published in 2021.

For understanding online social behavior and creating summaries of consumer interests, we use Helixa. For example, if we wanted to get a feel for the popularity and user profile of cryptocurrency in the U.S., we could use Helixa to build out an audience of those who have demonstrated interest in cryptocurrency exchanges on Twitter and then compare that audience’s traits to those of the general public (U.S. adults). When we input all the major exchanges in the U.S., our total audience adds up to about 5.89 million people. That gives us a great starting point in estimating the true size of the crypto enthusiast community. We’d also be able to learn new insights about our audience. For example, crypto enthusiasts are 58% more likely to also be sports enthusiasts. We’d then layer on our own custom primary research or data from our survey-based (declarative) data partner, GWI to complete the picture.

It’s important to reiterate that no one type of data can answer every question. In addition to custom primary research, our consultants use an evolving toolkit of declarative and behavioral data partners to best meet our clients’ unique needs.

To learn more, email Ron Li at RON@NVGT.COM.