NBA Finals TV Viewership Decline: Why the League is Still Positioned to Excel

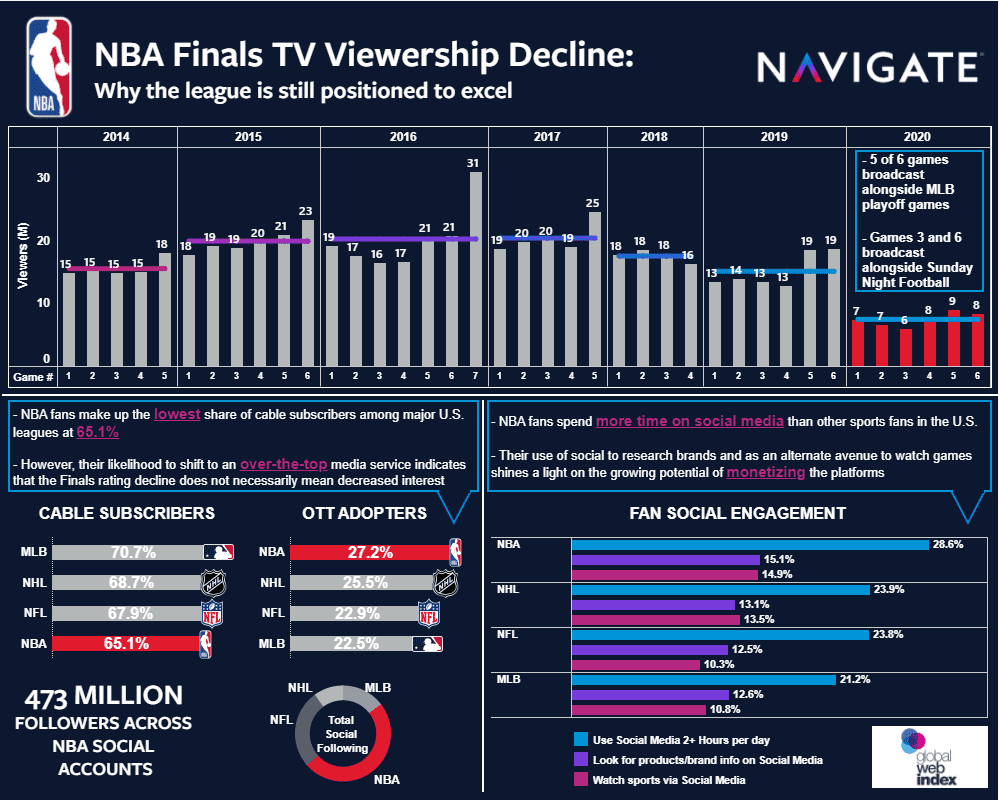

Game 4 of the Spurs’ sweep in 2007 was the last NBA Finals game to average fewer than 10 million viewers—until 2020. When the Finals schedule was set, it was clear there would be a battle for viewers. Game 1 would be played on the same day MLB broadcasted 8 of their playoff games, their most ever, and Games 3 and 6 were set to compete with Sunday Night Football for the first time.

Given the crowded slate of sports content during the NBA’s schedule due to COVID-19, it’s not overly surprising that the 2020 Finals set record lows for viewership (average of 7.45 million across the 6 games broadcasted). From a sponsor’s perspective, national viewership is a prime avenue for exposure, so losing more than half of the expected impressions for a campaign is nothing to brush off.

The Warriors-Cavaliers matchup led to a ratings increase each year from 2015-2017, but since then Finals viewership has slowly declined. This drop can certainly be attributed to the matchups and a crowded sports calendar this year. However, could it also be indicating another trend in how fans are consuming basketball? According to GlobalWebIndex (GWI), only 65% of NBA fans still subscribe to a cable service in comparison to an average of 69% among NFL, MLB, and NHL fans. While these numbers may seem concerning, NBA fans have the largest share of over-the-top media adopters among U.S. pro leagues (27.2%). This indicates that declining ratings do not necessarily mean decreased interest in the league. With the cord-cutter movement in full swing, leagues and teams will be tested to provide more and more sponsorship value across platforms outside of cable television.

One of the most important question marks for the NBA—and other pro leagues—is whether the effects of the pandemic will continue to force a competitive broadcast calendar. Even if the oversaturation continues, sponsors in the NBA have a major advantage over other leagues and properties: the league’s social media presence.

Social Media Following

Compared to 2019, this year’s Finals had roughly 46 million less viewers while broadcasting the same number of games. Though TV and social media impressions are valued differently, NBA league and team social accounts combined have a total reach of over 10X that number at 473 million followers. The NBA’s total social following nearly surpasses the NFL, MLB, and NHL combined. So, while losing TV viewers, the league makes up for that loss in the form of additional long and short-form content being seen and experienced by casual and passionate fans across the globe through social media.

Social Media Usage

Not only does the NBA provide the opportunity to reach a massive audience on social, but that audience is more engaged than fans of other leagues. According to GWI, 28.6% of NBA fans use social media for more than 2 hours every day compared to an average of 23% of fans for other leagues. Also, 15% of NBA fans look for products and watch live sports on social platforms compared to 12% of fans for other leagues.

If the sheer size of the NBA’s online presence doesn’t prove its value, this should. One of the most difficult parts about committing to an audience for a social media campaign is the question of whether it will actually turn into customers, and these insights from GWI showcase the league’s ability to help brands do just that. Monetizing sponsorable social media assets at the same level as television will still be a challenge, but the NBA is better positioned than other leagues to do so.

It’s likely the NBA’s viewership decline will prove to be temporary, especially if the 2021 season is scheduled to conclude before the NFL season begins. However, should the ratings problem persist, partners should focus on the value potential of social media to maximize ROI.

Appendix

Link to featured image public Tableau Report

GlobalWebIndex (GWI) is a target audience company that puts the power of audience insight into the hands of businesses worldwide. As a GWI ambassador, Navigate advises and connects companies to those insights and enhances GWI’s product, services, and customer experiences. To find out more about the Ambassador program or GWI, reach out to Drew Bolero at drew@nvgt.com or visit: https://www.globalwebindex.com/partners or www.globalwebindex.com/aboutus

Navigate uses Tableau to help clients manage and comprehend information with greater depth by building concise dynamic dashboards that make complex data easily digestible. For questions regarding Navigate’s capabilities in Tableau, please reach out to Drew Bolero at drew@nvgt.com.