Online Sports Betting – Baseline Behaviors and Sentiment

Part 2 of our 3-part series uncovers sports fans’ behaviors, sentiment towards sports betting, and how those sports fans who currently participate in sports betting (‘Current Sports Bettors’) differ. Maybe not surprisingly, Current Sports Bettors tend to be more avid sports fans across all major sports asked about. As time goes on, it will be interesting to see if high fan avidity leads to the propensity to bet or the opposite – you become a more avid fan of the sports you bet on. Maybe a mix of both.

Today, sports betting is somewhat polarizing – while only 21% feel negatively, slightly more (27%) feel positively. There is still a large contingent (52%) who feel neutral. With careful management, positive sentiment may continue to grow because 61% of sports fans agree that they think sports betting will continue to grow in popularity; however, this would make the U.S. the exception to what has been experienced in other markets. In the future, it’s expected that the percent of sports fans (fairly high at 52%) who are neutral about betting will take a stance, assuming their state legalizes sports betting. In terms of legalization, 22% of sports fans say that the legalization of sports betting would make them more likely to participate and this is especially true for Male sports fans (29%) compared to Female sports fans (16%).

Despite the growing popularity and relatively positive sentiment towards sports betting, there are still strong concerns. 54% of sports fans agree that children should be shielded from exposure to sports betting, which could pose a challenge for major companies that advertise heavily on television during popular sporting events and a challenge for properties who choose to partner with wagering brands. Because of the nascent stage of sports betting in the United States, some may still consider it the “wild west’ and 37% of sports fans agree that there should be government mandated regulations on sports betting. Sentiment towards sports betting is a mixed bag – sports fans are excited and interested, but they’re also hesitant and cautious.

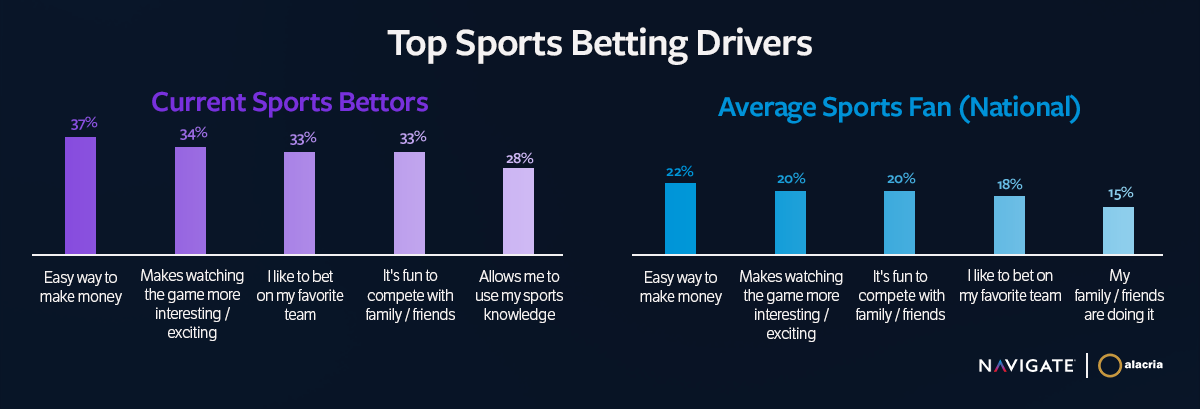

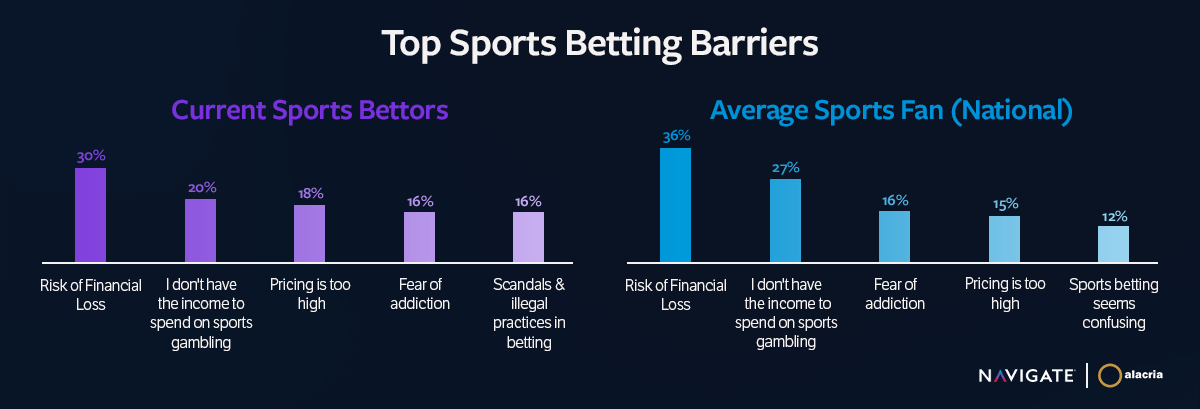

Some top drivers to overcome fans’ hesitancy is that it is an ‘easy way to make money’ with 22% of sports fans citing that as a top driver for participating in betting. One fan said, ‘It’s a great way to make some extra money and it makes sports more exciting’, which blends with the second top driver being that 20% of sports fans agree that sports betting makes watching the game more interesting and exciting. On the flip side, 36% of sports fans fear a risk of financial loss and 27% don’t have the income to spend on sports betting. One fan mentioned that s/he ‘cannot afford to lose.’ Of all barriers asked about, 60% of sports fans cited financial concerns as a barrier to participating in sports betting. The below graphics offer a detailed breakdown of the top drivers and barriers to sports betting among current sports bettors and average fans.

Although behavior and sentiment among sports fans is mixed, there are still very important takeaways for both brands and properties to consider when building out their strategy.

Positive Sentiment is High, But There are Things to Consider:

- Concern about children being exposed and those who support government regulation is high

- Now is a pivotal time for sports betting as people will start to settle their views over the next ~12 months. Lack of self-regulation can send sentiment in the wrong direction and put pressure on the government to intervene, as it has in Australia, France, Italy, the UK, and other markets.

- HOW you launch a partnership is critically important, should be sustainable that benefits both parties and the fans

- Consider investing funds into measures that regulate and manage partnership (i.e., what levels of integration they allow, educating athletes and staff, promoting responsible betting, digital protections for young or ‘at risk’ segments, managing athlete involvement in campaigns, etc.)

If you have any questions or would like to discuss the full report with our team, please contact Kayla Ketring at KAYLA@NVGT.COM.

* Insights / legal states were as of October 2021 when the study was fielded