Recession-Proofing Your Sponsorship Strategy

The near-term outlook for the sports industry is largely optimistic, but the prospect of an economic downturn is casting doubt on performance expectations for 2023. In particular, brands have shown concern about a possible recession as they turn to Navigate for help with recession-proofing strategies.

How likely is a recession in 2023?

Depending on whom you ask, we may already be in a recession. U.S. GDP has shrunk for two consecutive quarters, which by many definitions does signify a recession, however, there has yet to be a true consensus. For example, in a recent Wall Street Journal survey, economists suggested on average that there is a 63% chance of recession in 2023. While the exact timing and severity of a recession is unknown, many forward-thinking executives have already begun preparations.

How will it impact the sports and entertainment industry?

While no one wins in a recession, it’s often thought that our industry is more resilient than others. This is one of the primary reasons that sports investments have become a primary target of private equity groups as of late. But, are sports really immune to the negative effects of a recession?

Looking back at the recession of 2008 may help us understand where our industry is currently headed. In a February 2009 poll of 1,100 sports industry executives by Turnkey and SBJ, a third said their companies had laid off staff during the 2008 recession, while 2% said they had closed offices.

How will the effects of economic uncertainty be felt among properties, brands, media partners, and other stakeholders?

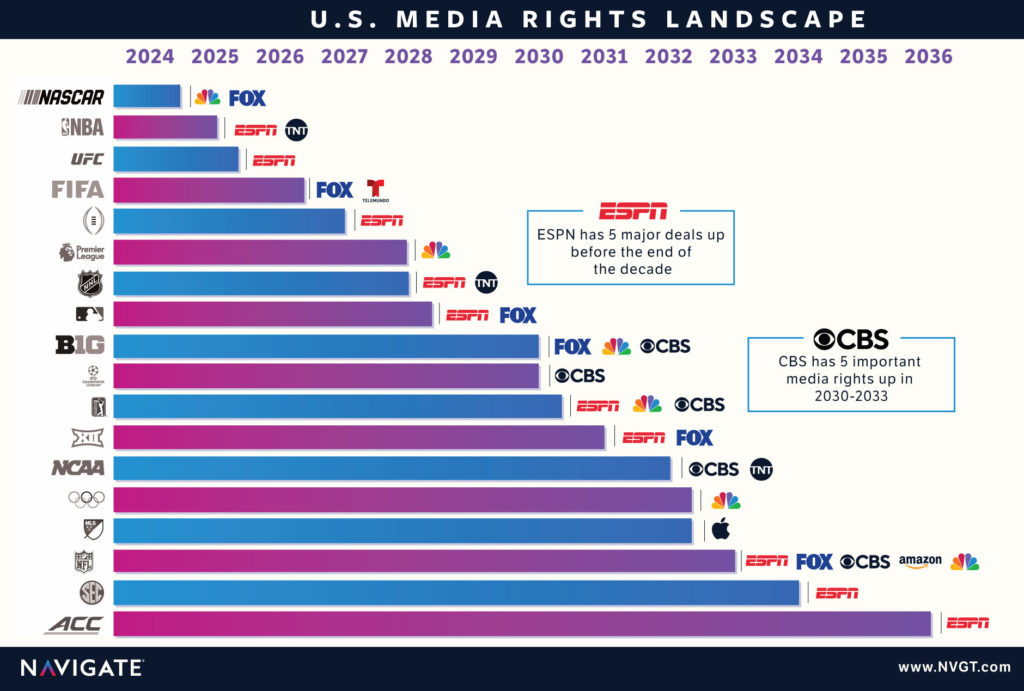

- Given that most media contracts are locked in for multiple years, a larger share of the burden could rest on media partners as compared to leagues and teams.

- The Global Sports Outlook 2023 from the Fitch Ratings agency suggests that while overall team revenue is actually expected to grow in 2023, we will see a dip in sponsorship-specific revenue, as brand budgets are reduced.

- Brands will be fighting a war on multiple fronts, as both sports and non-sports-related marketing budgets will be examined closely if not cut significantly.

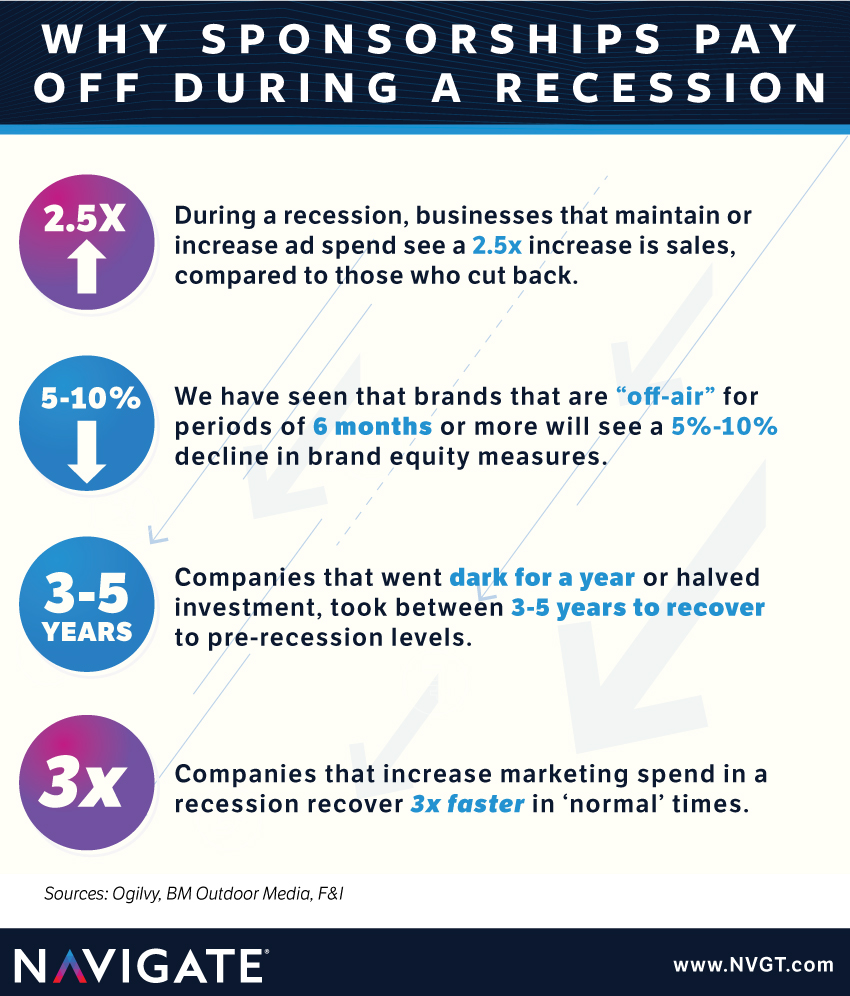

What can we learn about the sponsorship market from previous recessions?

During previous recessions this century, we’ve seen fewer naming rights deals and a decrease in Average Annual Value (AAV), but we’ve not seen a significant impact on term lengths.

If these trends were to continue, a forthcoming recession could create a buyer’s market for brands that are financially stable and willing to spend as the economic outlook worsens. We’d expect a similar outcome for non-naming rights sponsorship deals.

What strategies can brands take now to prepare for a downturn?

Organizations, if prepared, can actually capitalize on opportunities created by economic uncertainty. Our team has compiled the following recommendations to aid in the recession-proofing of your brand strategy:

Take advantage of first-mover opportunities and reduced competition:

-

- As demand for sponsorship assets decreases, brands that can weather the storm will have the opportunity to buy up the supply at lower cost.

- Properties have shown a willingness to create new sponsorship assets in times of economic uncertainty to generate more revenue. Some recent examples include NBA on-court logos, MLB pitcher’s mound sponsors, and NHL Helmet decals, all of which launched during the pandemic.

- “It just forces you to be that much more thoughtful about your approach, and making sure that the things you’re investing in are going to give you the right return” – Amy Azzi, Senior Director of Sports Marketing and Sponsorships at T-Mobile on a recent episode of Navigating Sports Business.

Understand your sponsorship objectives:

-

- Aware fans are 3x more likely to buy your product and are 2x more likely to recommend.

- A well-placed sponsorship is one of the most effective marketing strategies you can employ, particularly when budgets are tight.

- When considering investing in a sponsorship, you need to look beyond the CPM as you are likely to overpay on a CPM basis as compared to other marketing tactics. Instead, focus on the potential for fan awareness and impact.

Develop strategies to measure your sponsorship impact to ensure ROI:

-

- You’ll need to get more strategic with your sponsorship budget, but avoid slashing deals prematurely without a long-term plan.

- Once the sponsorship starts, you need to make sure you have a mechanism in place for actually measuring the awareness and impact the sponsorship is getting you.

- Make sure to develop KPIs to benchmark, track, and measure the success of your sponsorship objectives.

- Measuring sponsorship impact is complex. Navigate leverages a combination of secondary data and primary market research to measure sponsorship impact as directly as possible.

- Hear from AJ Maestas on how to properly measure your sponsorships true ROI:

Consider cause-related marketing strategies:

-

- Connect with your target audience by authentically showing how your brand is helping communities recover from economic difficulties.

- American sports fans are 13% more likely to buy brands that reflect their values and 17% more likely to stay loyal to brands they like.

- Read more of Navigate’s suggestions for cause-marketing strategies here.

With a potential economic downturn afoot, now is the time to prepare to take advantage of the opportunities that may arise. If you have thoughts or questions about strategizing for 2023, please email our SVP of Analytics & Innovation Matt@NVGT.com.