The $2 Billion Impact of a CFP Expansion

Huge news in the world of college football was made public recently as it was revealed that the CFP intends to expand from 4 teams to 12 teams in the near future. While nothing is certain yet in terms of who will own certain rights to the new games, and how revenue will flow to all of the different stakeholders, it’s clear that this expansion will provide a massive financial lift to all Autonomous 5 football schools.

To help estimate the value of expansion, it’s been widely reported that the current AAV of just the 3 CFP games is $470M, which comes to $6.75 per TV viewer. Assuming the underlying assumptions of media rights value increases seen across the NFL, NHL SEC and other sports properties, a 50%+ lift in value per TV viewer is very reasonable, so let’s assume the new marketplace is $10.40 per viewer.

Next, assuming TV viewership increases by 25% each round until the National Championship (which is about the lift we’ve seen recently from the Semi-Finals to the Championship), total TV viewers for all rounds of the CFP would grow to 183M, which would include all 11 games.

At $10.40 per viewer for 183M viewers, the AAV of the 12-team playoff is right around $1.9B, or a 212% lift above the current $608 AAV from ESPN’s deal today. It’s important to note that this new deal, however, would lump all NY6 and CFP payouts together since they would likely all be part of the new 12-team playoff.

When factoring in other potential revenue streams, like a portion of ticket sales and sponsorship revenue, which currently only account for 10-15% of CFP revenue, the average annual revenue generated by the CFP could eclipse $2B.

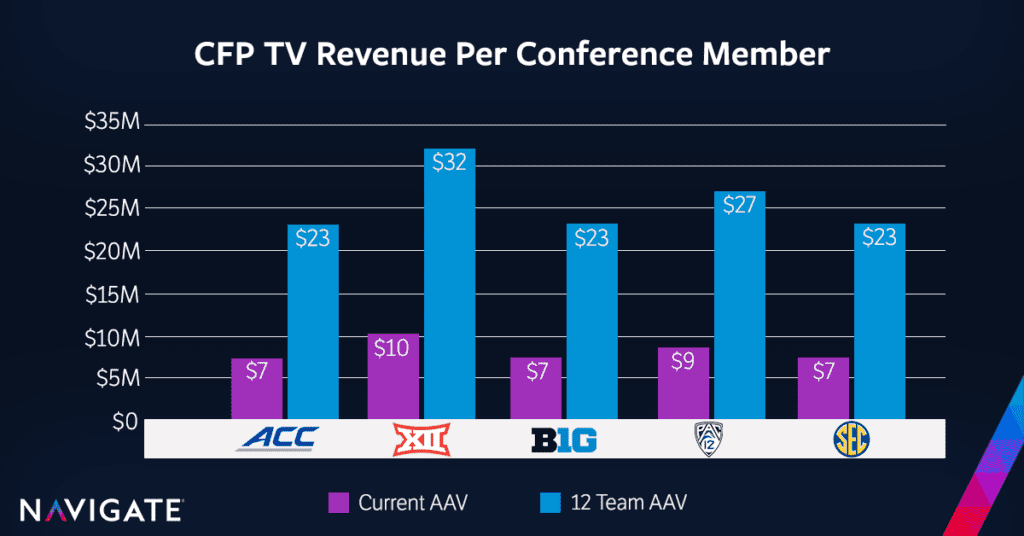

At the individual A5 conference level, given that the base payouts are evenly spread today no matter how many schools are in each conference (the ACC, Big Ten and SEC have to split 14-ways while the Pac-12 only splits 12-ways and the Big 12 only splits 10-ways), and assuming all conferences are of equal quality, below is a graphic on the incremental impact of expansion per school in each conference.

- ACC – $7M today – $23M after expansion

- Big 12 – $10M today – $32M after expansion

- Big Ten – $7M today – $23M after expansion

- Pac-12 – $9M today – $27M after expansion

- SEC – $7M today – $23M after expansion

While it may seem that these values are extremely high and that media companies may not be willing to pay these fees for content, it’s important to note that the rate at which brands have been paying to reach TV audiences has increased by an average of 8% per year and the fees that consumers have been paying for live sports, even in OTT bundles like YouTube TV has been increasing by more than 15% per year. So, the buckets where media companies like ESPN are recouping revenue (advertising and subscriptions) are increasing even faster than the growth in media rights.

For more information on the CFP expansion, check out the following articles:

- Associated Press – CFP expansion could increase annual revenue to $2 billion

- USA Today – Possible CFP expansion could increase revenue to more than $2 billion

- Mercury News – College Football Playoff expansion: Pac-12 annual revenue could triple under 12-team format

- The Athletic – College football’s staggering $2 billion option: How a new playoff could triple the payout