The Importance and Value of Brand Equity

As COVID-19 continues to disrupt the sports world and leagues and teams decide to abbreviate or cancel their seasons altogether, it is more important than ever for properties to stay as engaged as possible with their fans. Continuing to entertain, inform and reward your fans are all vital roles of properties, especially when it comes to maintaining and building brand equity.

Why is brand equity so important? Because in the event that normalcy and expectations start to break down, like marquee athletes getting injured, a rough stretch of poor performance, or in the case of the Big Ten and Pac-12 (and maybe other conferences by the time this is published) football seasons, the events that drive 70-85% of total revenue for entire athletic departments are all postponed, brand equity is all that properties have left. As long as brand equity remains intact, fans will continue to crave content and flock back to their TVs and stadiums in a post COVID-19 world, but a loss of brand equity could potentially erode fan bases and leave the future of athletic departments in doubt.

As Navigate has consulted with various brands, teams, leagues and collegiate conferences around the impact of COVID-19, questions have started to arise as to the current levels of brand equity, and the main factors to consider when estimating the value.

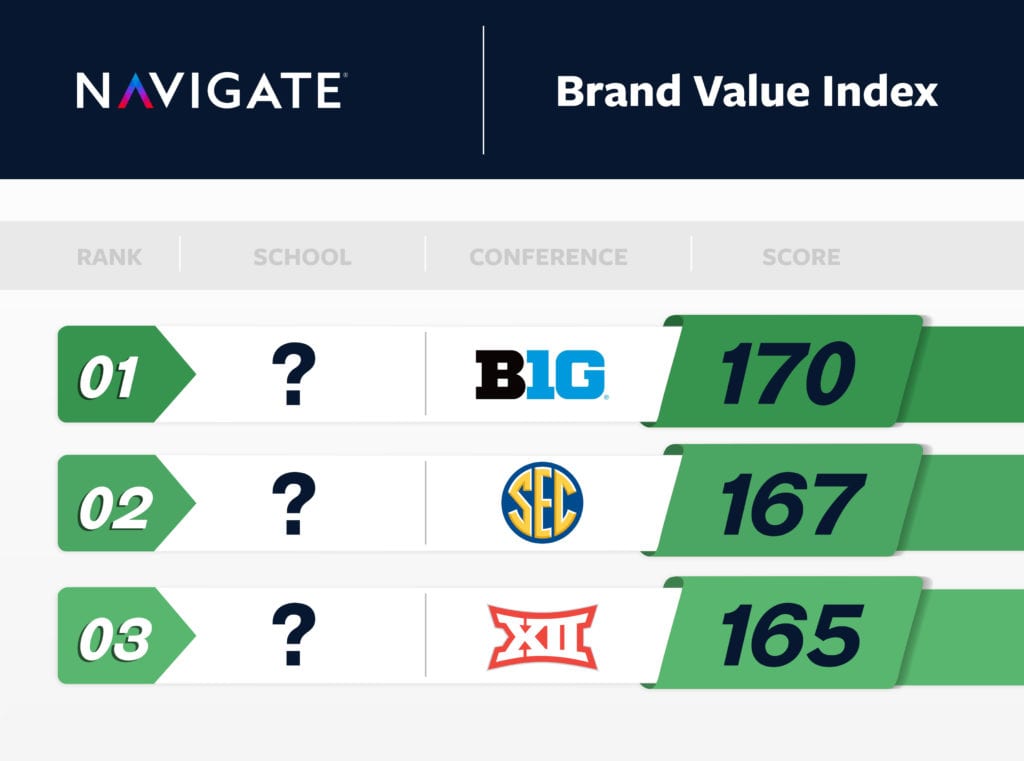

As an answer to this question on the collegiate side of the business, Navigate created the Brand Value Index by taking into account three primary variables:

- Revenue per Fan – Total revenue reported by the athletic department divided up between the estimated number of fans across the country. This variable is used to take into account the passion levels of fans, especially when it comes to spending money to support their teams.

- Fan Base – Estimated number of fans across the country. Overall popularity is the main driver of this variable, which alone is a great indicator of brand equity as the reach is a result of the power of the brand over a long period of time.

- Fan Percent of State Population – Estimated number of fans divided by the total population of the state where the athletic department is located. The ability of a property to become the most popular in its own state and beyond proves the saturation level of the brand in the community.

By taking these three factors into account, below are the top 10 brands ranked by Brand Value Index.

This list outlines the athletic departments that have already built up a solid level of brand equity, and likely don’t have to worry about fan bases declining as long as they are continuing to engage with fans, which is especially important news for Big Ten and Pac-12 schools that may not see the field of play for several months. However, for the athletic departments that feel they might be lacking in all of the three variables driving these results, the time is now to start engaging and building brand equity before it’s too late.