Why Crypto Partners are Willing to Pay a Premium for Sports

The above infographic contains excerpts from a much more comprehensive Blockchain/NFT/Crypto report. Please contact Kevin Kane Kevin@NVGT.com for more information.

Overview

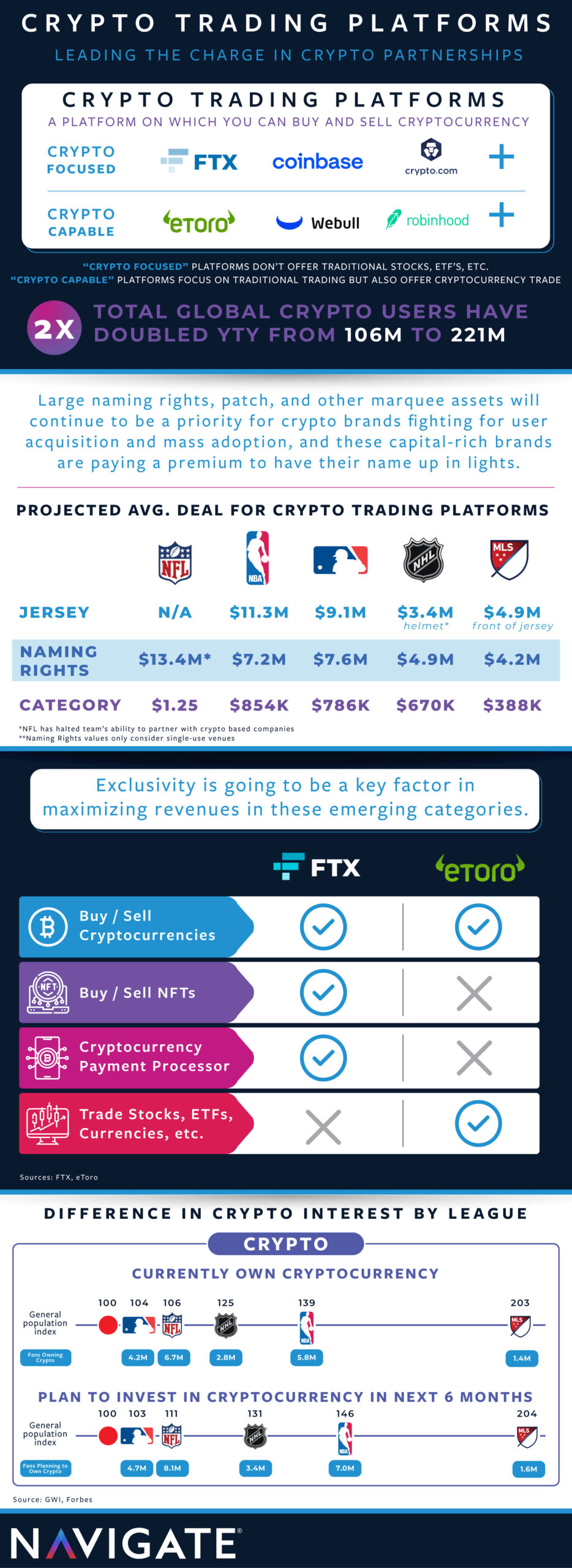

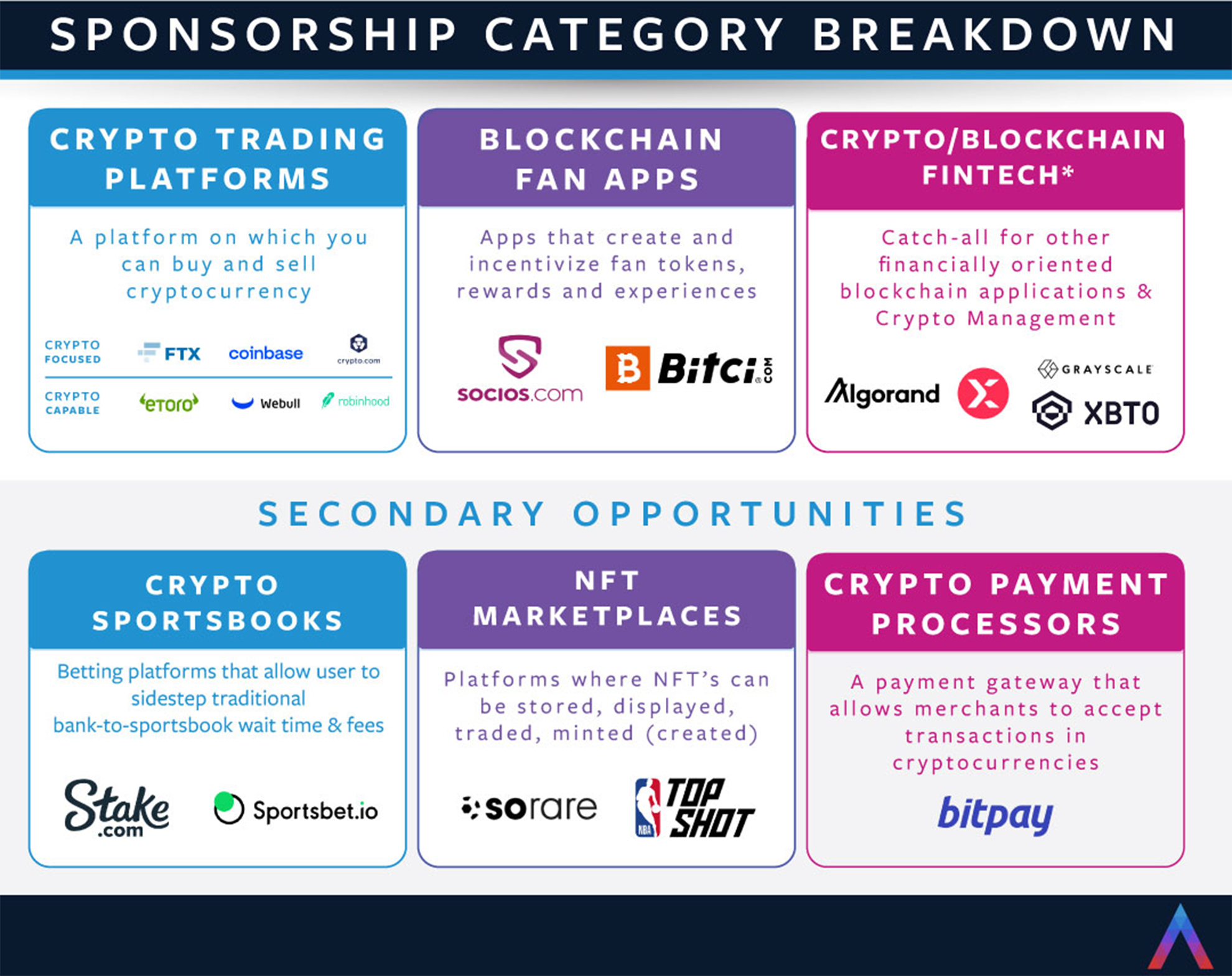

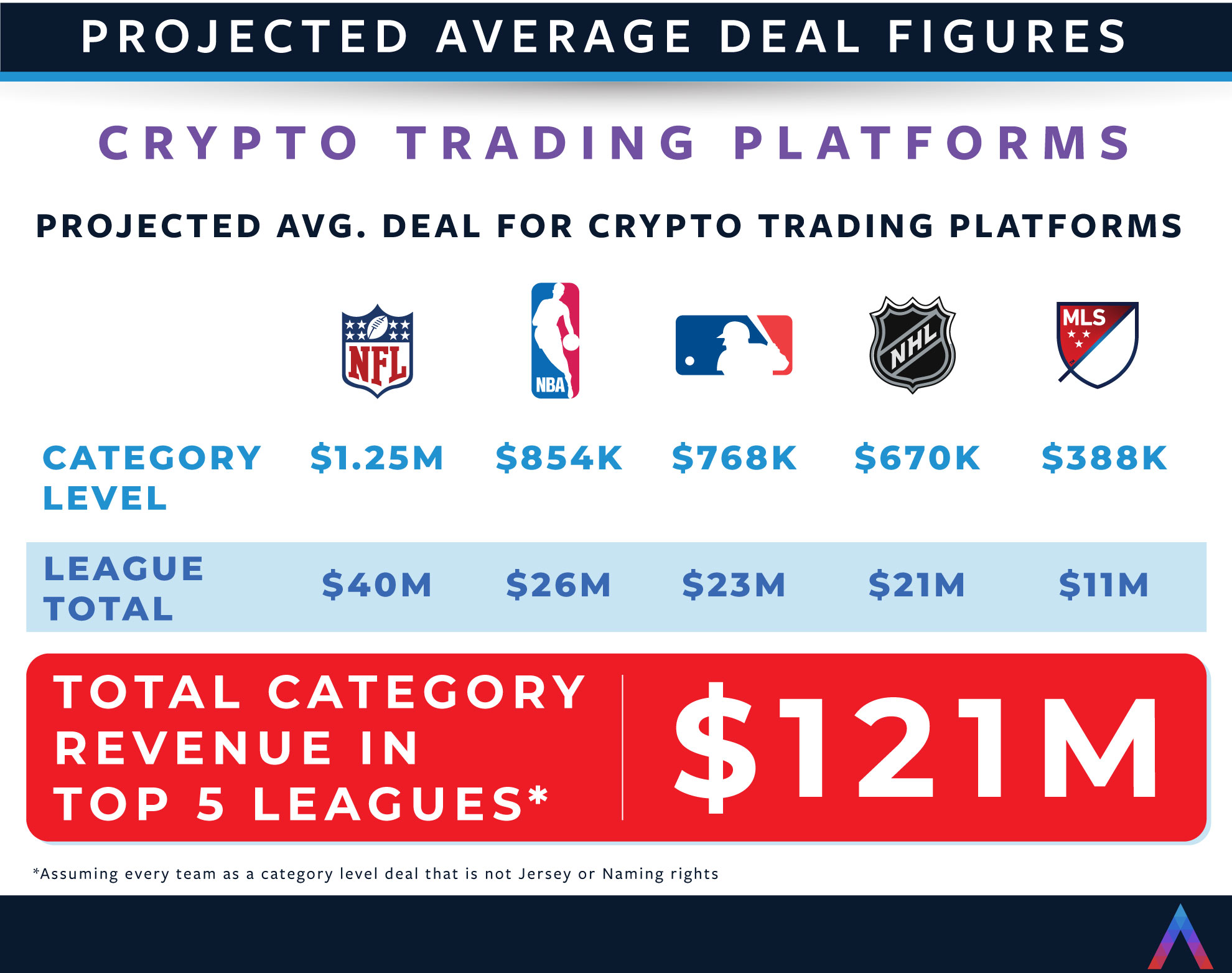

As the ever-changing crypto sponsorship landscape unfolds before our eyes, the Navigate team decided to break it down in layman’s terms, project partnership revenue, and emphasize the key strategic points to the deals being done. The primary focus of this infographic is the crypto trading platform sub-category, as this is the most legitimate and expansive of the sub-categories. The majority of crypto naming rights and jersey deals are being done in this space (Webull signing a $30M/year jersey deal with the Nets, FTX signing a $135M naming rights deal with the Heat, etc.). Every day these categories shift and blend towards each other, but as of right now this is how we see the entire crypto and NFT category breakdown.

Crypto trading platform brands come in two main categories. “Crypto focused” platforms, which don’t offer traditional financial products like stocks or ETF’s, and “crypto capable” platforms that focus on traditional trading, but also offer cryptocurrency trade.

Crypto Trading Platforms and the Importance of Selective Exclusivity

Exclusivity is going to be a key factor in maximizing revenues in these emerging categories. As seen in the primary infographic, FTX and Etoro’s platform offerings go beyond just the ability to buy and sell Bitcoin. Blockchain technology has many applications across industries and categories so when negotiating with crypto exchange brands it is very important not to designate all blockchain technology implementation to one brand. Additionally, it is equally important to talk to current partners who might have plans in the space, such as financial service partners, to strategically identify the categories you will be pursuing, seeing if those current partners have plans to expand in that space, and be upfront with desired revenues and interest from other brands.

Crypto Trading Platforms Bullish on Sponsorship

How has the crypto exchange market impacted sponsorship? To answer this question we took a deep dive into the value of average category deals, naming rights, and jersey partnerships from the top 5 leagues for both crypto trading platforms and comparable categories (financial services, insurance, gambling, technology, etc.).

Through our analysis we found that crypto trading platform brands were paying a 36% premium for jersey patch deals and a 26% premium for naming rights. This premium is compared to what we thought deals would land at, not a comparison to the average. For instance, we estimated the Brooklyn Nets would get roughly Golden State Warriors equivalent of $20m/year for jersey patch, but in this case the $30M/year received from Webull would be a 50% premium.

As a highly competitive space with a wide range of emerging brands vying for brand awareness and user acquisition, crypto trading platforms have clearly found value in high profile sponsorships. Taking this a step further, we used this analysis and compared categorical averages in revenue per team in each league to project what a crypto exchange might pay for the following types of deals for an average team in each league.

Why Sports for Crypto?

Many have coined this “an arms race for user acquisition”. In the relative infancy of this category, crypto and blockchain companies are trying to be top of mind when users finally decide it is time to either dive into cryptocurrency investing or other utilizations of the blockchain. The main objectives for these brands are to establish mass-adoption, elevate their legitimacy, and build credibility for IPO/funding by showcasing largescale investments & longevity of contracts. Sports is the avenue for their marketing efforts due to the alignment of demographics, and global reach + exposure of marquee assets. As this arms race for user acquisition rolls on, urgency is a main factor and teams need to be proactive instead of reactive in this space to maximize the current premium in sponsorship deals. Properties need to come prepared with a strategy on who to partner with, why their fans align with the category, and activations on how crypto brands can enhance fan experience. With the global crypto users doubling in the last year, and no signs of that slowing down, there is clear indication the time is now, and crypto trading platforms are striking while the iron is hot.

If you have any questions on the topic please email Kevin@NVGT.com.