Seizing Opportunity in a Changing Media Landscape

Sports are at the epicenter of a shifting media landscape, accounted for 94% of 2022’s most watched broadcasts. Legacy media companies rely on these broadcasts to drive reliable viewership for advertising revenue as cord-cutting continues to increase. As audiences adopt streaming options at a higher rate, opportunities are created for both properties and media partners to find value by being prescient and strategic with their long-term planning and negotiations.

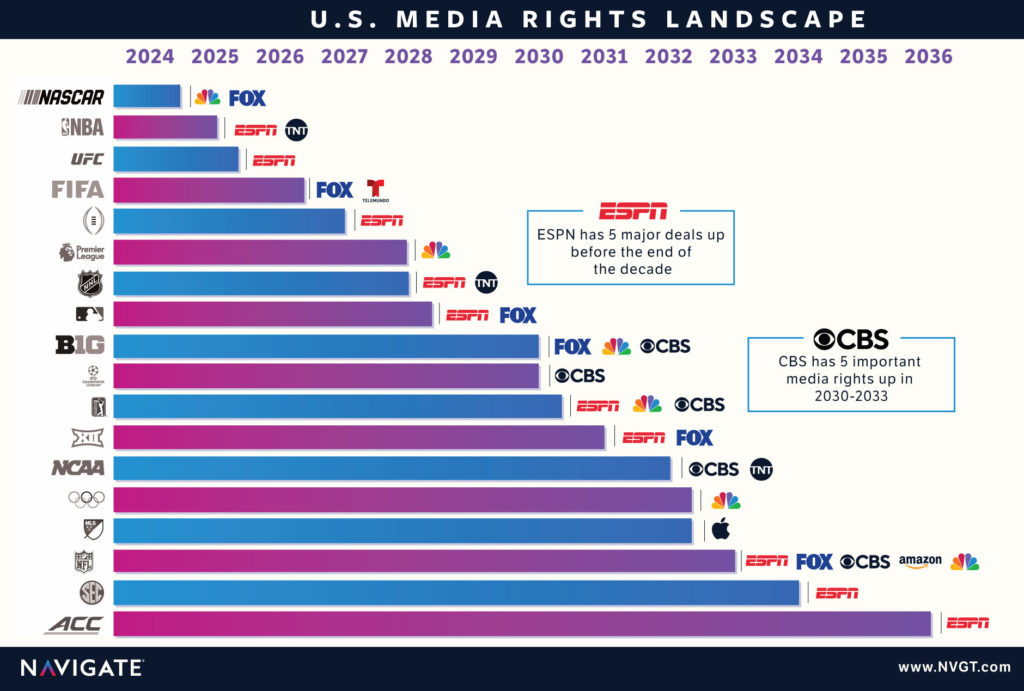

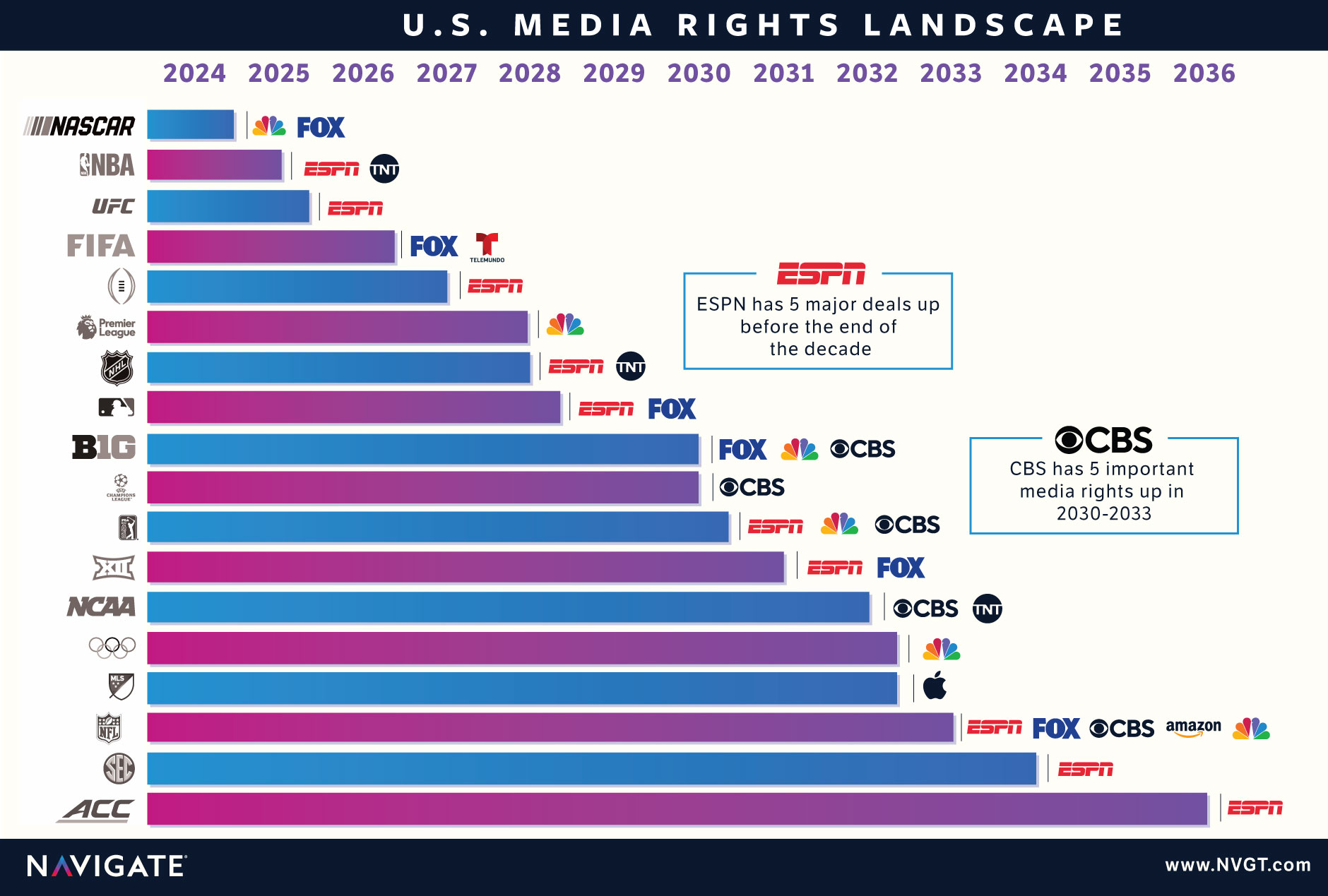

ESPN will face major decisions, especially on the heels of rumors that Disney is looking to sell a stake in the network following declining revenues, as five core rights agreements are set to expire in the next five years. Apple and Amazon have emerged as viable partners for marquee properties in sports, which has already started to create flux in the marketplace. With the NFL having an option to prematurely end their deals, most of the marquee rights might be on the market before the end of 2030. We expect that new entrants will have increased their market share considerably by the end of the decade.

So why is the marketplace changing?

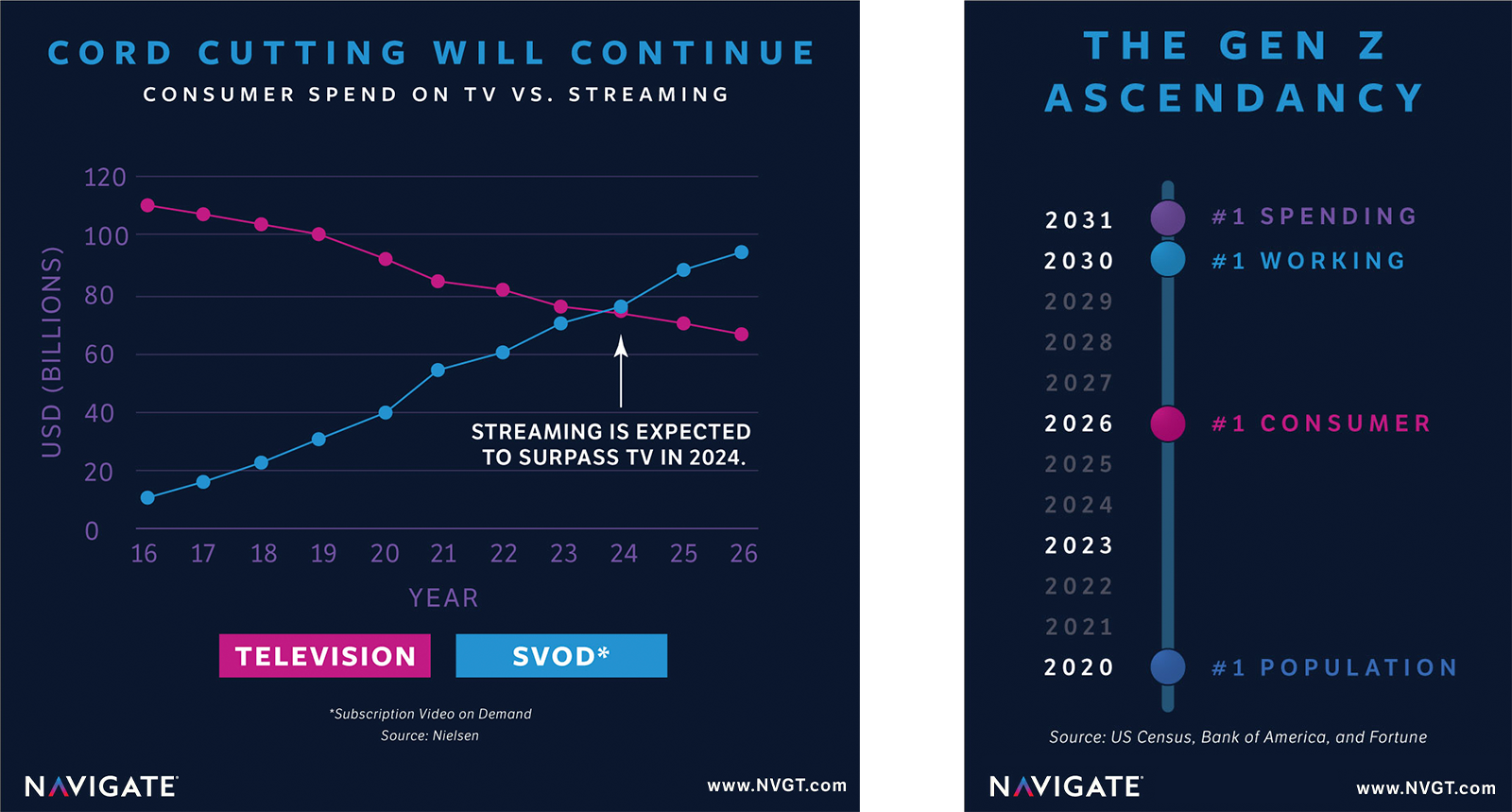

Subscription video on-demand (SVOD) is projected to overtake cable for the first time in 2024 in terms of consumer spend. Total streaming hours already surpassed cable in 2022, signaling a seismic consumer behavior shift towards OTT. Much of that change is driven by Gen Z, which became the largest population segment in 2020, and is expected to become the #1 consumer population by 2026. Millennials still hold the most discretionary income and have an important role in the next few sets of deals. As most marquee rights are expected to be on the market by the end of 2030, Gen Z, alongside Millennials, will shape the next cycle of sports media rights. Gen Z is more likely to consume content digitally than prior generations, creating opportunities for streaming platforms and spurring important strategic considerations for properties.

The current market factors still favor traditional media in many ways, but like everything in this space, that is changing quickly. When marquee rights become available, Big Tech brands have the cash to reshape the landscape. Morgan Stanley estimated that the majority of the projected 7.2% YOY growth in sports media right values are due to heavier investments from Amazon, Apple, Netflix, and more.

How is it impacting sports?

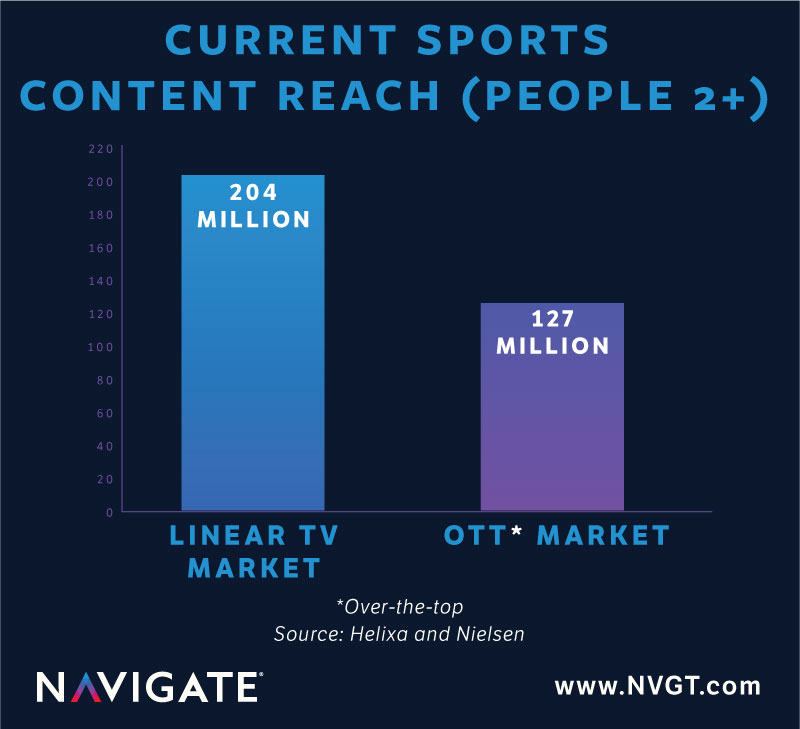

Currently, Linear TV provides properties a significantly larger audience. As the audience shifts towards streaming platforms, the gap continues to narrow. The audience size differences lead to hesitations from the properties as a partnership with an OTT platform will lead to lower reach. However, we expect that as the gap closes, the ability to better understand and target your audience will outweigh the reach considerations.

The gap in total reach between TV and streaming is visible in the cost-per-viewer metrics observed in recent NFL and A5 college football contracts. Tech companies have to spend roughly 2X more to acquire the same rights on a per viewer basis. However, streaming services are not as reliant on viewership to drive advertising revenue as their legacy competitors.

We’ve observed some of this shift already globally, as bifurcation of media rights deals has become more common. IPL’s recent cycle of negotiations produced different partners for TV and digital broadcasting with roughly the same value. Rightsholders should consider carving out different packages with even more intention to maximize their value.

It’s important to note that the CFB OTT example used in this analysis is the contemplated Apple x Pac-12 deal, which despite not materializing, serves as a great demonstration of the higher cost-per-viewer for OTT platforms compared to legacy media.

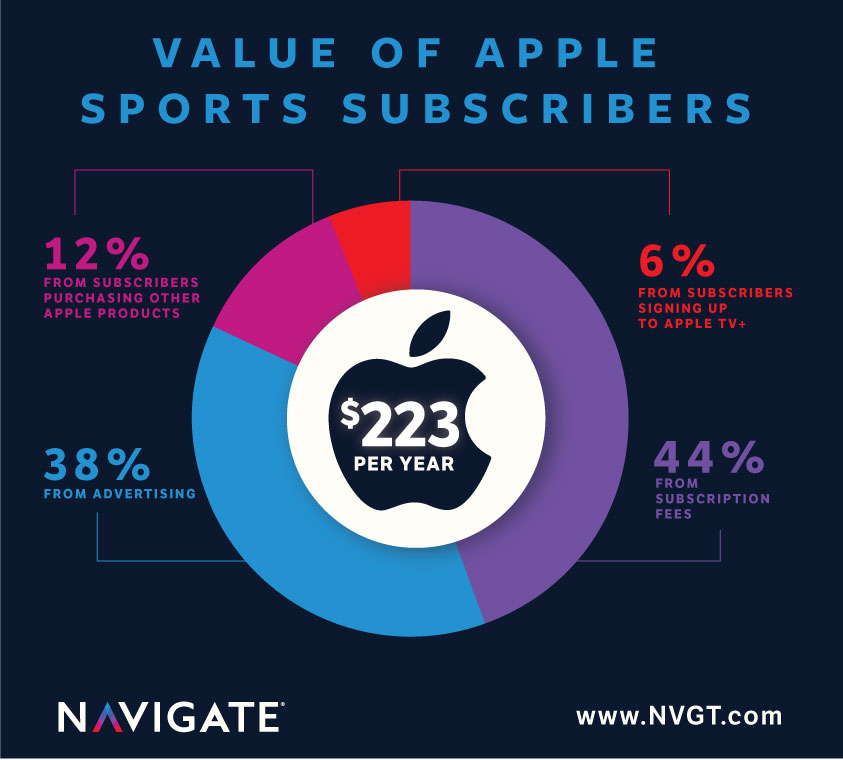

As we consider how Apple would have potentially benefited from the Pac-12 deal, we see that 58% of the value is not linked to advertising revenue. OTT platforms can charge a significant subscription fee without having to package other content to receive retransmission / carriage / affiliate fees from viewers.

Streaming platforms can generate additional revenue from viewers in ways that TV networks can’t, such as bringing the consumers to their existing ecosystem, additional subscriptions for their content platforms, and offering more targeted advertising due to a better understanding of their audience. We estimate that Apple can generate $223 in revenue each year per consumer that subscribes to its sports packages, like MLS Season Pass.

What does this all mean for you as a rights holder?

- The streaming business model is vastly different than traditional TV, and you need to understand it in order to maximize the value of your rights.

- Streaming platforms offer different value propositions, and although these might be non-cash, they are still important pieces of the puzzle.

- Understand that while your total viewership might decrease, you will be in a better position to reach the next generation whilst simultaneously having a better understanding of your current audience.

While the media landscape may seem nebulous and confusing, there are still a few definite truths. The first is that digital is on the rise, but that doesn’t mean that legacy media companies are going away anytime soon. The second is that the side with the clearest understanding of the shifting dynamics in the near- and long-term will be the one who walks away from the table with the most stable future. Lastly, we know that viewership remains the biggest driver of value, so fan engagement and creating quality programming still make up the foundation of success for both properties and media partners.