What’s on Deck for MLB in 2024 and Beyond?

With the 2024 MLB season underway, we wanted to explore some of the business-side trends that have been top-of-mind in deciding the future direction for MLB. We are entering a pivotal moment for baseball, and this season could be predictive of the next decade or more. The below infographic showcases some of our insights as they relate to the biggest storylines for this year and the future.

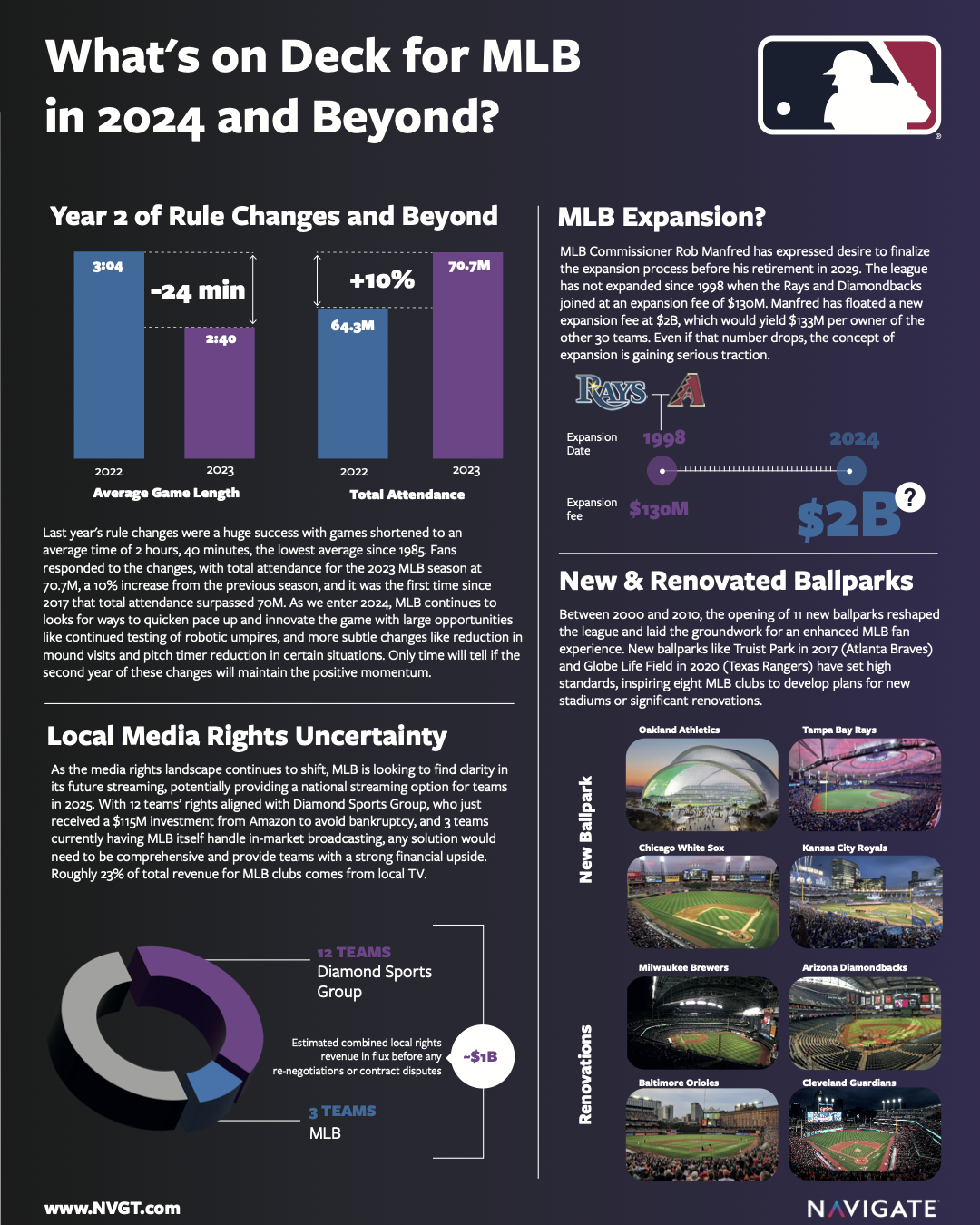

Year 2 of Rule Changes and Beyond

Only time will tell how year two of the MLB rule changes (which Navigate proudly helped research and support on launch) will continue to affect the overall game. Obviously, the year one results were a huge success with games times shortened to an average time of 2 hours, 40 minutes – a decrease of 24 minutes when compared to 2022 and the lowest average since 1985. These changes helped total attendance for the 2023 MLB season reach 70.7M, a 10% increase from the previous season, and it was the first time since 2017 that total attendance surpassed 70M. As we enter 2024, MLB continues to look for ways to quicken pace and innovate the game with continued testing of robotic umpires as well as more subtle changes like reduction in mound visits and pitch timer reduction in certain situations.

The question still remains – will the second year of these changes maintain this positive momentum? The role of change and innovation does not need to stop with just the pace of the game, but potentially re-imagining the baseball fan experience for the modern era – this may include leaning into new technologies, better marketing of star players, and more deeply integrating fantasy/sports betting.

Market Expansion

While it’s unlikely that concrete plans for expansion materialize in 2024, the prospect of reaching 32 teams is becoming increasingly likely. Commissioner Manfred has expressed his desire to finalize expansion prior to his announced retirement in 2029, so we may hear news sooner rather than later, especially now that the Oakland A’s saga is (somewhat) wrapped up. Potential destinations for new teams include Charlotte, Las Vegas (most likely the new home of the A’s), Montreal, Nashville, Portland, Orlando, Salt Lake City, and San Antonio/Austin, five of which have existing baseball infrastructure (minor league franchises), organizations working to get an MLB franchise and, in some cases, a proposed ownership group.

The most recent wave of expansion, in 1998, saw the Diamondbacks and Rays paying expansion fees of $130M each. Manfred has suggested that number could be as high as $2B this time around. Two new teams joining could therefore mean a payout of roughly $268M to each of the other 30 owners.

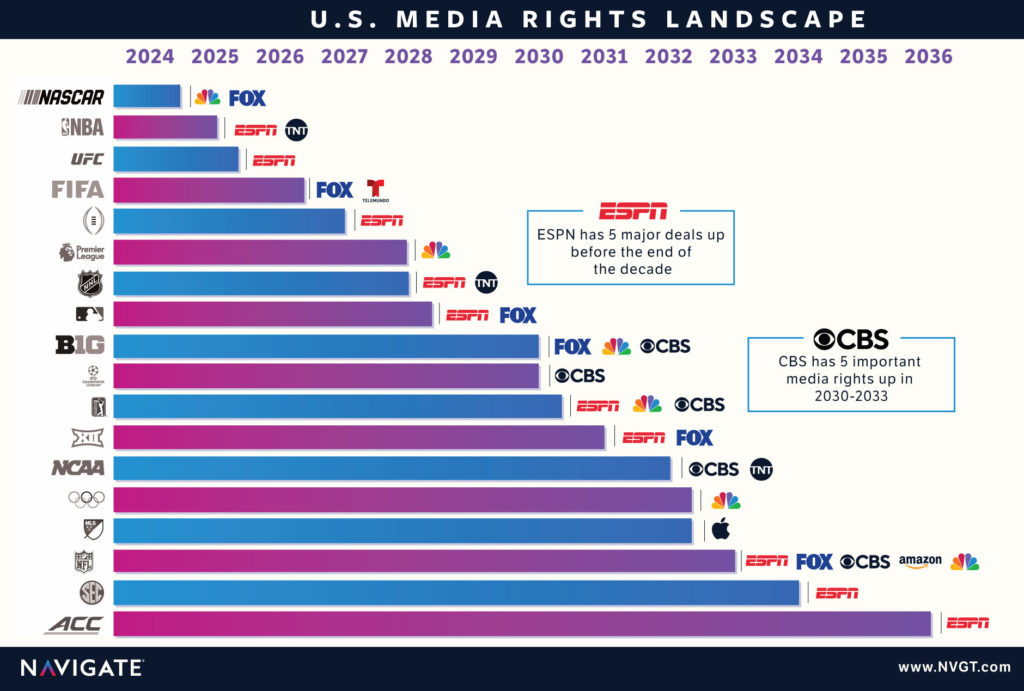

Local Media Revenue

As the media rights landscape continues to shift, MLB is looking to find clarity in its future streaming. Commissioner Manfred has discussed providing a national streaming option for teams, starting in 2025. The league already operates the MLB.TV platform but this is restricted to out-of-market broadcasts while local rights are held by an array of regional sports networks (RSNs) for in-market viewers. A major catalyst to this issue was the bankruptcy of the largest owner of regional sports networks – Diamond Sports Group (DSG), who currently holds 12 MLB teams’ local rights. Amazon’s recent $115M investment into Diamond Sports Group adds yet another layer to an already complex situation. This partnership would dramatically increase Amazon’s sports offering in the U.S., building on its success with Thursday Night Football.

Any type of streaming service would need to provide teams with a strong financial upside as currently ~23% of total revenue for MLB clubs comes from local TV. There are 15 teams for whom local media rights are still in flux: 12 with DSG and another three whose local broadcasts are being handled directly by MLB. These 15 clubs combine for an estimated ~$1B in local rights revenue that is still uncertain pending any re-negotiation. It is obvious that the eventual solution needs to be comprehensive in its efforts to solve the future of broadcasting for MLB.

New Ballparks

Teams are entering a period of significant ballpark renovation and construction unseen since the early 2000s, with efforts expected to shape attendance and potentially pave the way for league expansion. Between 2000 and 2010, the opening of 11 new ballparks reshaped the league and enhanced fan experiences, accompanied by substantial public investment and policy changes.

Although recent years have seen fewer major investments in facilities – with notable exceptions being Globe Life Field for the Texas Rangers in 2020 and the Atlanta Braves’ Truist Park in 2017, upcoming months will see eight MLB clubs embarking on funding efforts or finalizing plans for new stadiums. Two of the clubs involved, the Oakland A’s and Tampa Bay Rays, have been working for over 20 years on new ballparks and are seen as anchors for possible expansion to 32 teams in the league. Teams with announced plans for new and renovated ballpark are:

New Ballpark:

- Oakland Athletics

- Tampa Bay Rays

- Kansas City Royals

- Chicago White Sox

Major Renovations:

- Arizona Diamondbacks

- Milwaukee Brewers

- Baltimore Orioles

- Cleveland Guardians

Other Trends to Consider

While the factors brought up here are important, there are several other areas we continue to monitor on including:

- Team Spending & Economic Balance

- International Expansion

- MLBPA & MLB – Collective Bargaining Agreement (after 2026 season)

The 2024 MLB season will provide clues as to what the future of baseball looks like from a business perspective. MLB has an opportunity to usher in a new era of younger fans, increased revenue, potentially two or more new markets, and state-of-the-art facilities. Stay in touch throughout the season for more insights and research into the evolving landscape of Major League Baseball.