Fan Survey: How are fans reacting to the seismic PGA TOUR/PIF announcement?

The events of May 30th may have been the biggest development in professional golf since the PGA TOUR formally broke away from the PGA of America in 1968. The PGA TOUR, The Public Investment Fund (‘PIF’), and the DP World Tour (‘DPWT’) signed a framework agreement to combine the golf-related commercial rights of the TOUR, DPWT, and PIF into a collectively owned, for-profit entity referred to as “NewCo” for now. Though this effectively ends golf’s civil war between the TOUR and the PIF-owned LIV Golf, many questions remain unanswered about the future of men’s professional golf

Despite the significant reaction so far, the deal has yet to be finalized as it faces regulatory scrutiny in addition to public controversy. On June 6th, the day the controversial agreement was revealed, publicity around PGA TOUR was over 37 times higher than the daily average in 2022 (per Meltwater).

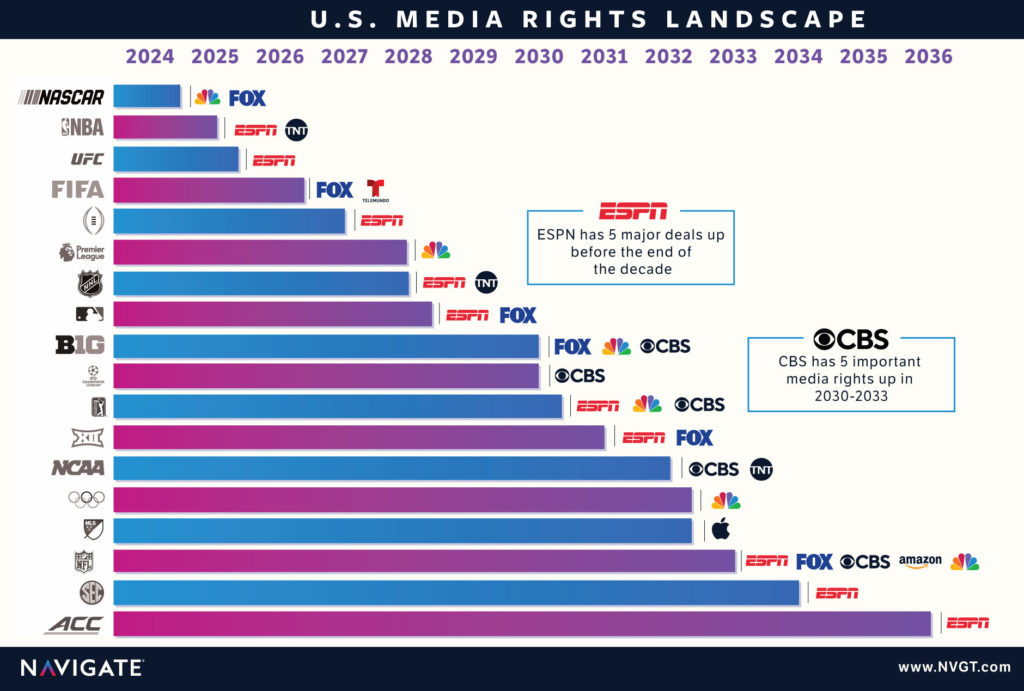

As the first of potentially multiple Senate hearings approaches around NewCo, Navigate polled American golf fans to understand how the golf community feels about NewCo, what its golf engagement intentions are moving forward, and what these early results may indicate for corporate partners in golf across media, sponsorship, and more. We paid particularly close attention to how responses varied across generations.

Summary of Key Survey Takeaways

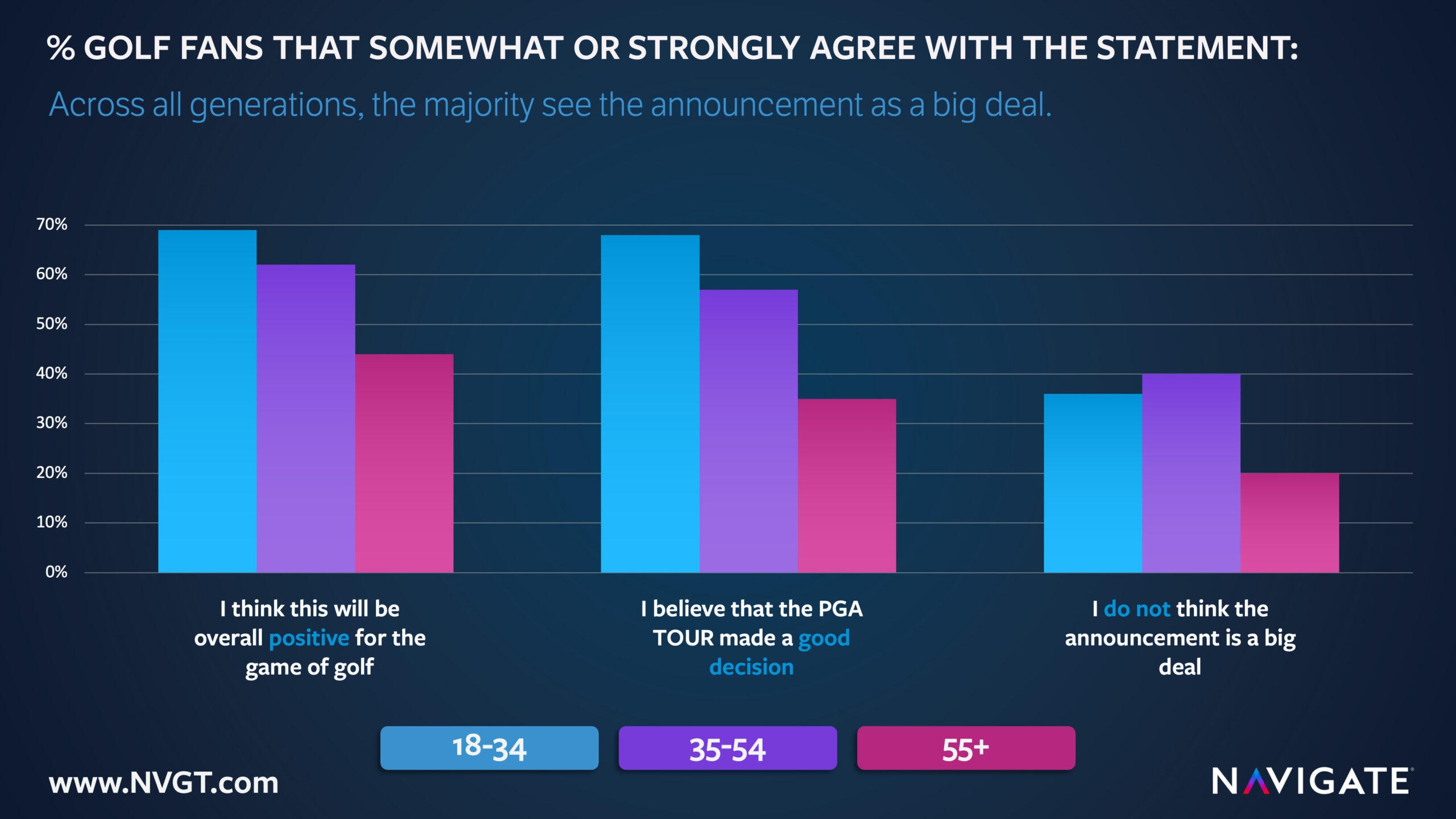

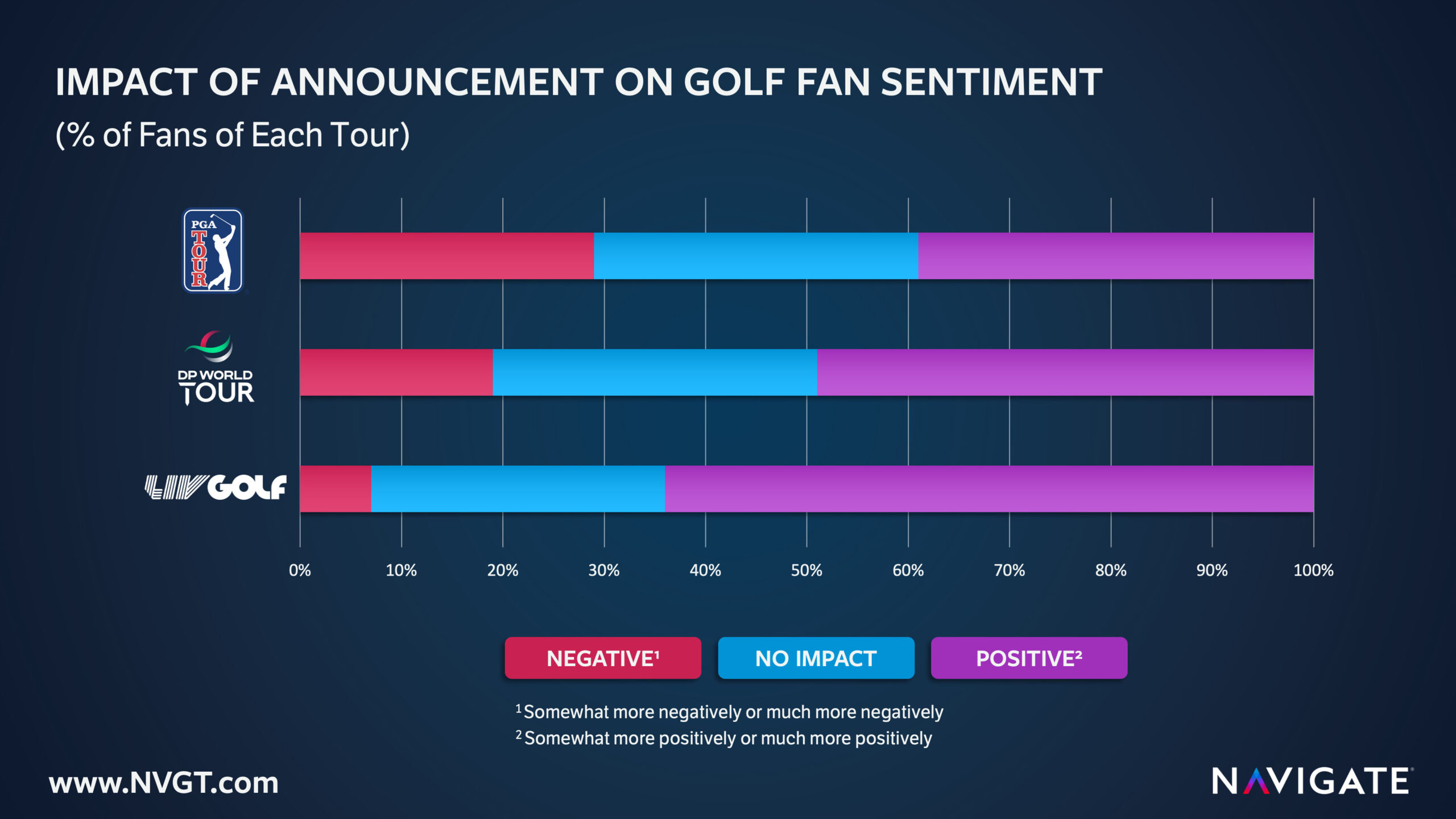

- The negative news headlines that followed the PGA TOUR, PIF, and DP World Tour announcement may not be consistent with overall American golf fan sentiment. Most PGA TOUR and DP World Tour fans saw the announcement in a positive light. Fans that saw it negatively are in the minority.

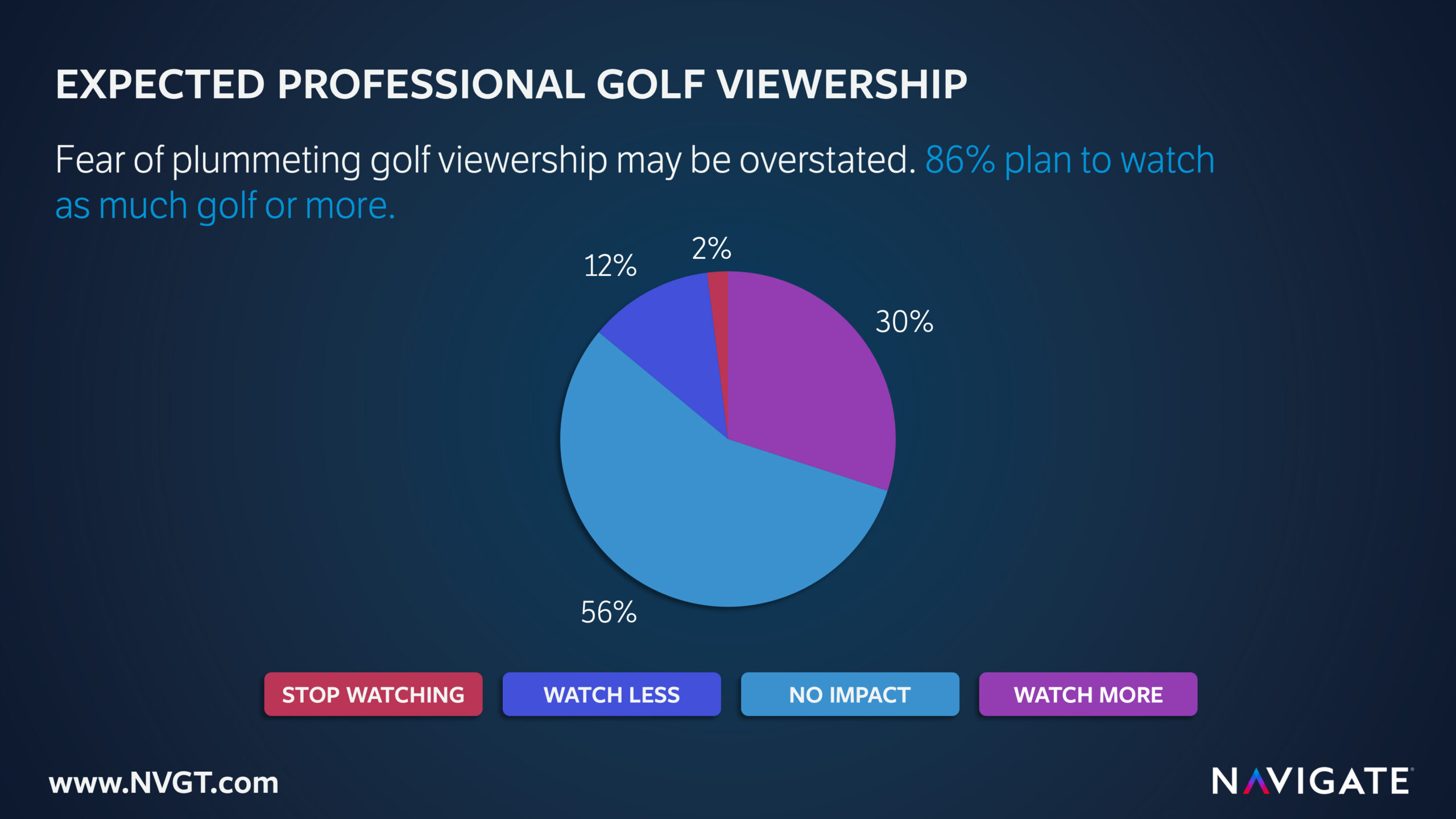

- Fear of plummeting golf viewership may be overstated. Over half of American golf fans do not plan on changing the amount of professional golf they watch while nearly a third intend to watch more. Just 1 in 7 fans plan on watching less or stopping altogether.

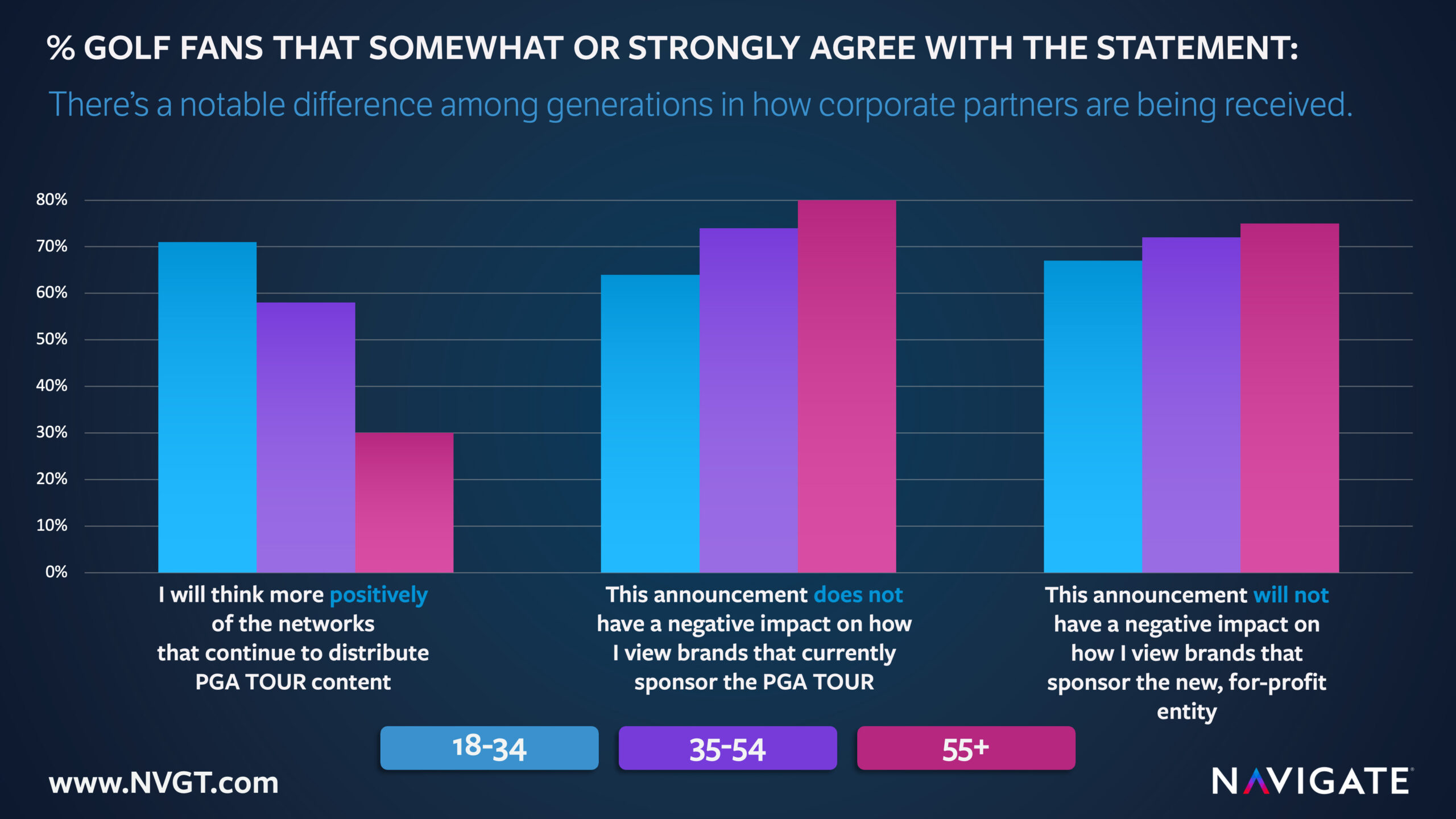

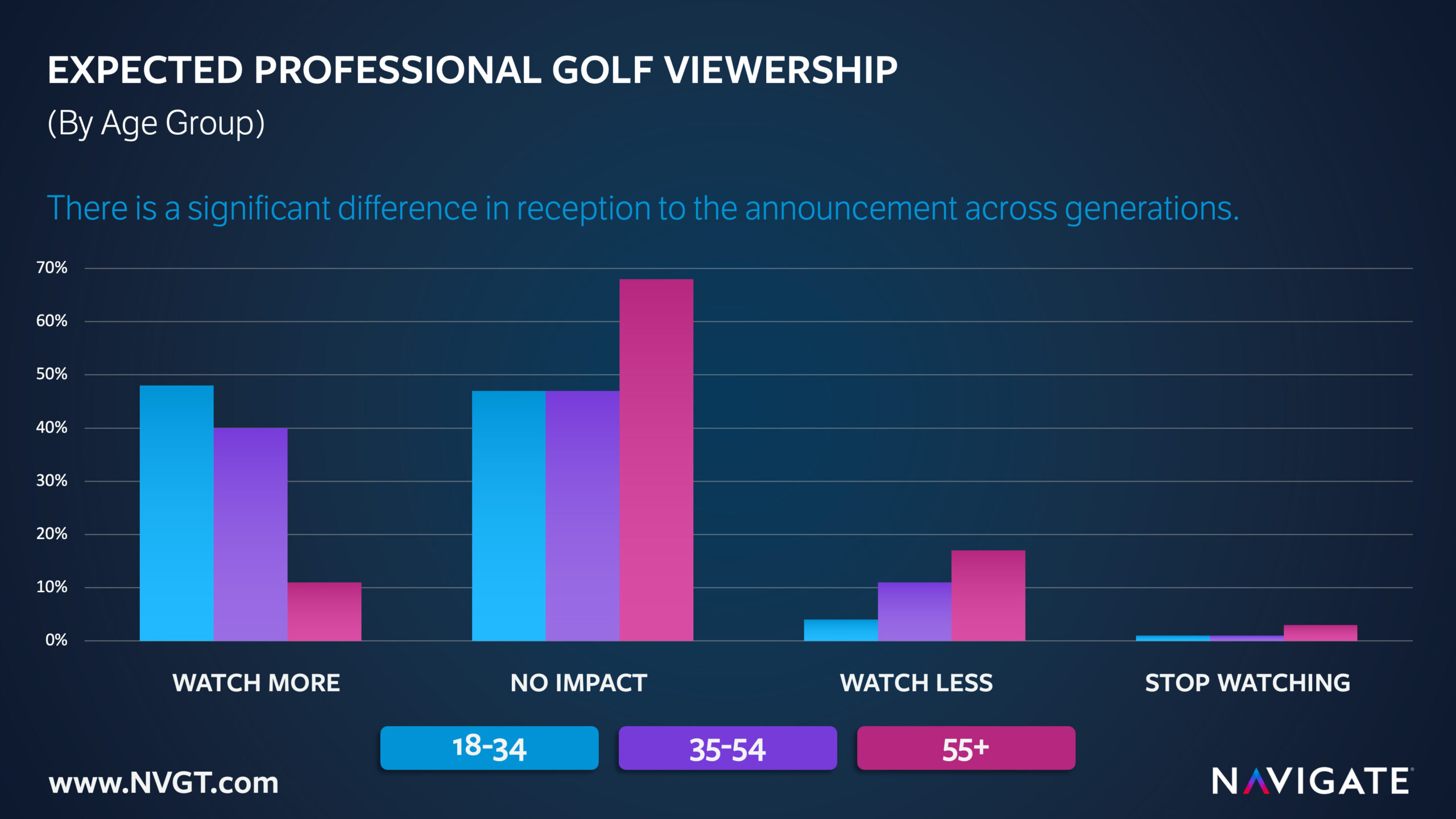

- The announcement is being perceived differently across generations. Moving forward, 18 – 34-year-old golf fans are much more likely than older cohorts to engage more with professional golf, see it as positive for the game, and view broadcasting partners of the new entity in a more positive light. However, sponsor perception is more inelastic among older fans.

Survey Takeaways in Detail

-

The negative news headlines that followed the PGA TOUR, PIF, and DP World Tour announcement may not be consistent with overall American golf fan sentiment.

- Most TOUR and DP World Tour fans saw the announcement in a positive light.

- One-third of PGA TOUR and DP World Tour fans’ opinions of each tour didn’t change.

- PGA TOUR and DP World Tour fans whose opinion soured are in the minority.

-

Fear of plummeting golf viewership may be overstated

- Over half of American golf fans do not plan on changing the amount of professional golf they watch. Nearly one-third say they will watch more!

- Just over a tenth say they will watch less, and only 2% say they will stop watching altogether.

- Nearly half of 18 – 34-year-old golf fans expect to watch more professional golf, compared to 11% among 55+ year-olds.

-

The announcement is being perceived differently across generations.

- 18 – 34-year-old golf fans are more likely to think positively of PGA TOUR broadcast partners, but view brand sponsors more negatively than other generations.

- Fans 55+ are the most uncertain about the future of golf.