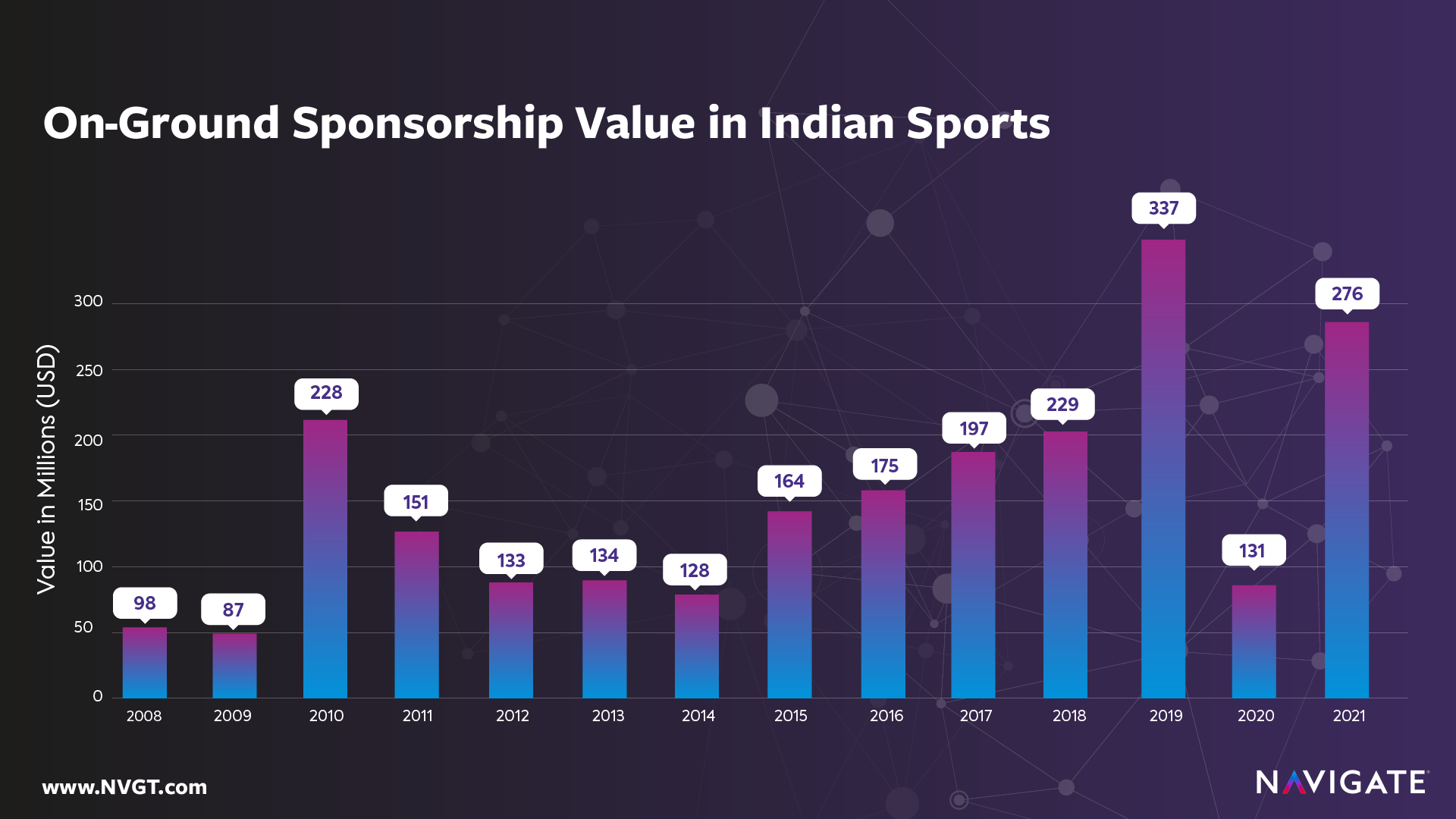

Surge in Spend: The Growing Sport Sponsorship Market in India

For U.S. sports leaders, a working knowledge of the Indian sports industry is becoming increasingly important for deal-making and long-term strategy. India’s improving economic climate, rising disposable incomes, and improving economic outlook have helped the Indian sports Industry touch the $2.7 billion mark, up from $1.3 billion just five years ago. A recent Navigate intern, Ujjaval Chaudhary, originally from India, helped break down the numbers behind the Indian sports landscape, and the large sponsorship deals that are driving much of the revenue.

India is a country with an incredible passion for sports that dates back 8,000 years to the Vedic (Ancient) Age. Today, the prevalence of sports in India continues to grow. The Indian government recently made a significant investment in the future of sports, allocating $413M to the Ministry of Youth Affairs and Sports. This is an increase of 11% over the previous fiscal year’s budget of $372 M. These funds are primarily distributed to athletic organizations with the goal of increasing sports development in India.

In recent years, as Indian companies have increased their market caps, their sports sponsorship portfolios have increased as well. When it comes to aligning with Indian sports fandom, the most obvious target is cricket, specifically the Indian Premier League (IPL). The IPL and the Indian Cricket have a combined viewership of over 1 billion each year.

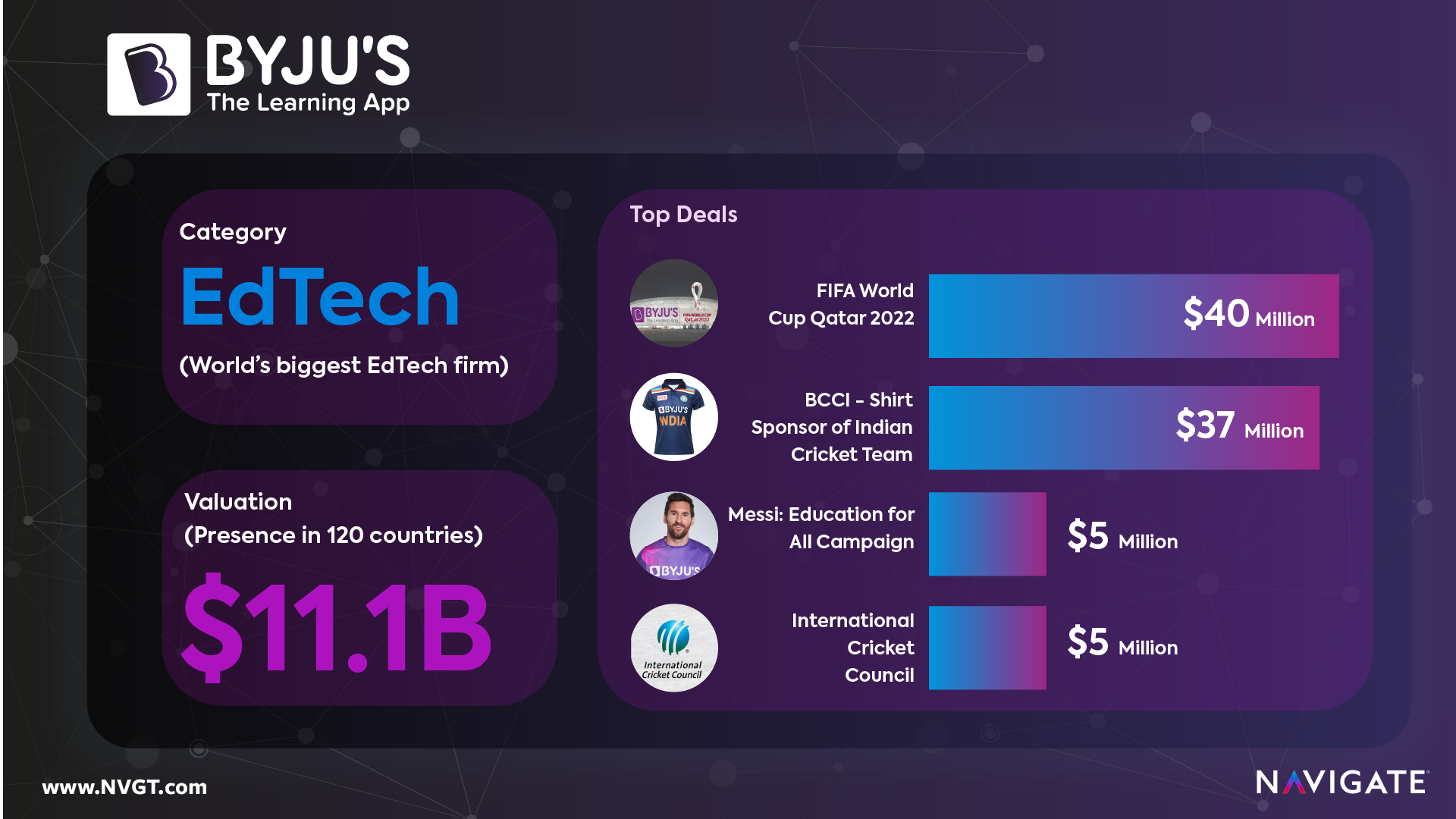

Understanding the sharp increase in sponsorship spend requires an understanding of the organizations behind the investment. Below, we detail some of the biggest sponsors in Indian sports, and the properties in their portfolios.

Byju’s:

The COVID shutdowns in India kept schools closed for almost two years. The result was a boom for EdTech startups. A young population, a vast base of smartphone users, and the cheap rates of mobile data have helped the sector continue to grow immensely. For context, 1GB of mobile data in U.S. costs $5.62, compared to just $0.17 in India.

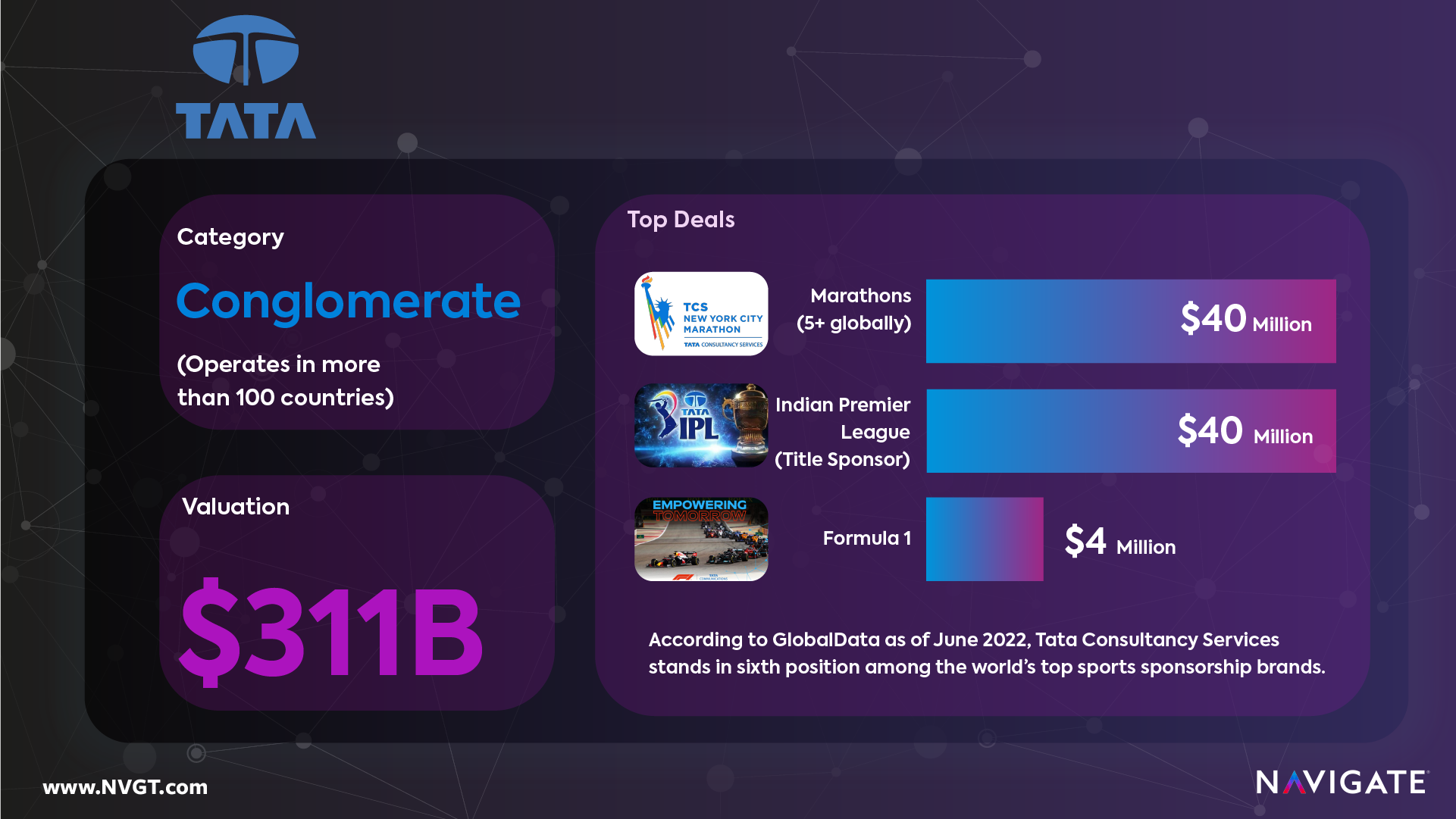

Tata:

Tata Consultancy Services is the title sponsor of the IPL for 2022 and 2023. Additionally, it has been the title sponsor of the TCS NYC Marathon since 2014; arguably the largest marathon in the world. NYC is just one many global running events sponsored by TCS, including the Amsterdam Marathon and the TCS Lidingöloppet. These events embody TCS’s commitment to supporting the communities around

the world in which it operates.

Dream11:

India’s fantasy sports market was valued at approximately $25.44B in 2022 and is expected to reach around $72.06B by 2030, at a CAGR of 13.9%. The industry, which has already grown significantly over the past six years, is estimated to have invested $375M in real-world sports via sponsorships and partnerships with sporting leagues and is expected to make a cumulative contribution of $3.5B to the overall sports economy between FY22 and FY27. India has emerged as the fastest-growing market in the world, with over 300 fantasy sports platforms having a user base of over 180 million.

Amul:

Amul is the ninth-largest dairy product producer in the world and the largest food company in India. After becoming the Indian Regional Sponsor of the Portuguese Men’s National Soccer Team, COO Jayen Mehta said, “Milk is the world’s original energy drink and it’s great to associate with an energetic and world-class team like Portugal. Amul will have access to their complete match archives. We will be able to use the footballers’ images on our product lines, as well as creatives, till the end of 2023.”

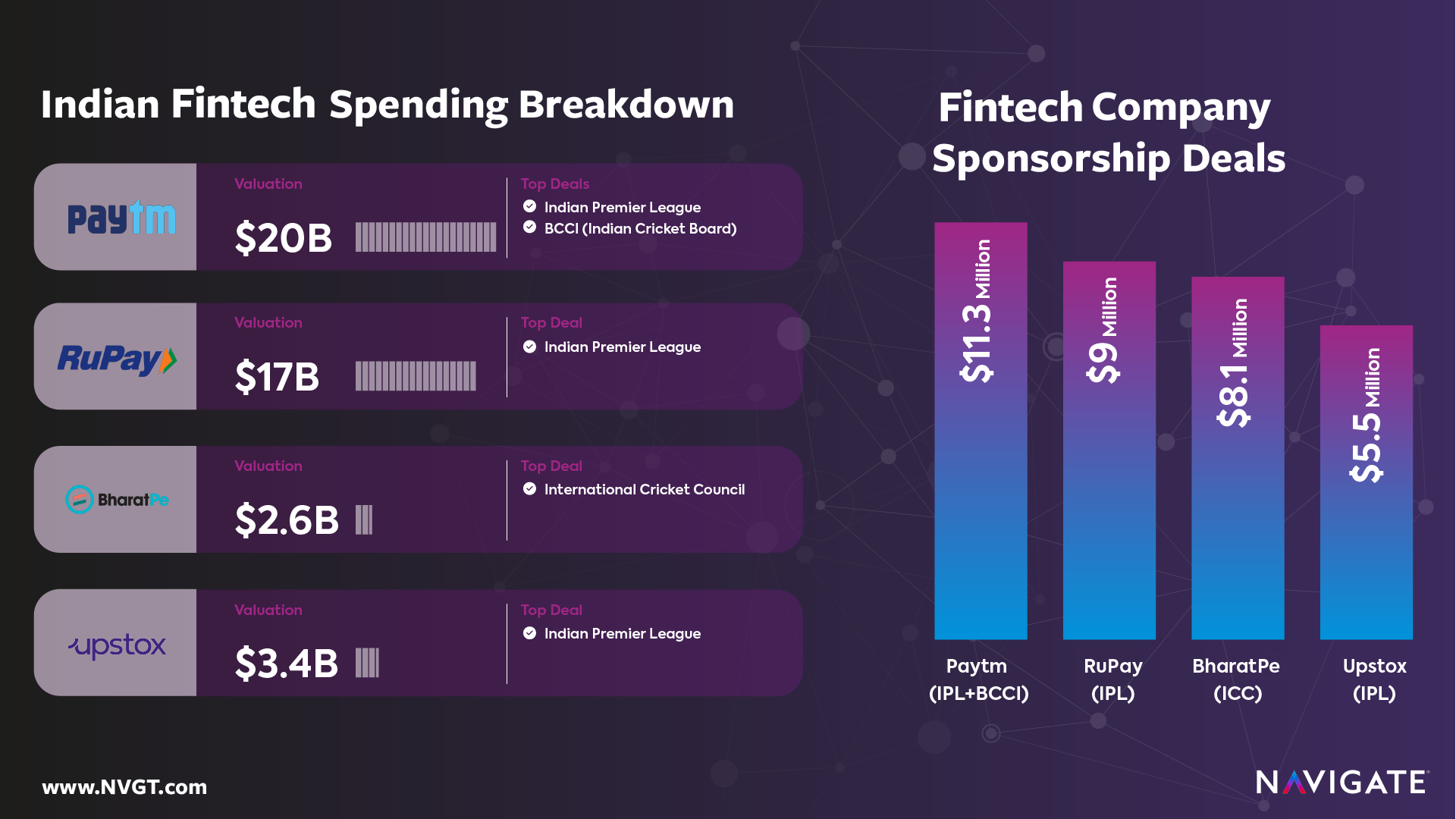

The Rise of Fintech:

In 2016 the government of India announced the demonetization of the banknotes (bills). At that point in time, more than 85% of the transactions were done through cash nationwide. The move aimed to digitize the financial system, which created a great opportunity to capture the market for fintech startups such as Paytm, RuPay, BharatPe and Upstox. Fintech has since become a hot category in the sports sponsorship market.

Monitoring developments in India is critical for both brands and properties around the world. As the Indian economy continues to grow, particularly in the tech sector, these emerging companies will provide increased sponsorship investment in both national and international markets. The impact on the global sports industry is uncertain, but promises to be significant in the coming years.