The Explosion of NBA Top Shot

Have you ever been watching your favorite team in a big game, jumped out of your seat as the star player hits the game winning shot, and thought, “I wish I could own that moment”? Yeah, I’ve never thought that either – but now with NBA Top Shot that thought may be a reality.

If you don’t follow the NBA you may not have heard of NBA Top Shot. Started by blockchain company, Dapper Labs, in partnership with the NBA and NBPA, NBA Top Shot sells short video clips of highlights in packs to collectors, who can then buy and sell them on a marketplace, much like collectable trading cards.

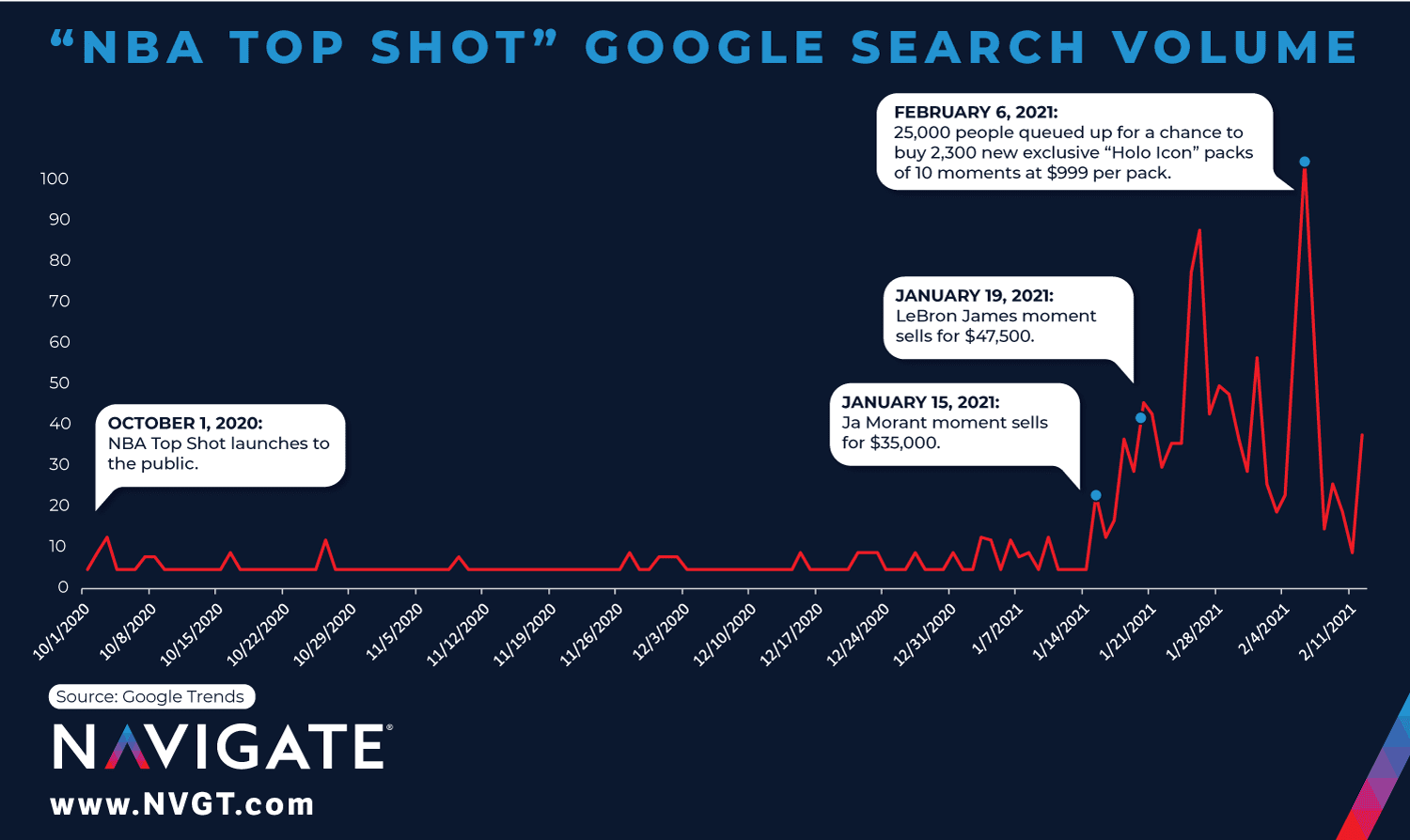

Since NBA Top Shot launched to the public on October 1, 2020 it has exploded in popularity as a perfect convergence of two white-hot markets: trading cards and cryptocurrency. Top Shot has already generated over $100M in sales and Dapper Labs (also famous for CryptoKitties) is now valued at over $2B.

After a gradual interest in the initial months the Top Shot market exploded on January 15 when a Ja Morant highlight (No. 1 of 49) was sold on the platform’s secondary marketplace for a then-record $35,000 by an owner that purchased it 50 days earlier for $2,000. Four days later a LeBron James dunk (No. 23 of 59) sold for $47,500, and on January 22 another version of the same LeBron James highlight sold for $71,455 (No. 1 of 59). Since that time the record has been broken five more times, with the current record sale a LeBron James “Cosmic” dunk sold for $208,000. Currently fourteen moments are listed on the marketplace with minimum asking prices of $100,000 or more, with a Ja Morant dunk listed as the most expensive with a $250,000 asking price.

What explains the appeal of NBA Top Shot?

With anyone able to watch any NBA highlight on YouTube with the click of a button, why would anyone be compelled to own an NBA Top Shot moment? The same argument could be made about trading cards. If anyone can Google an image of the Mickey Mantle rookie card that just sold for $5.2M, why would anyone want to own it?

Like trading cards, the value in NBA Top Shot lies in its scarcity. Top Shot moments are non-fungible tokens (NFTs), meaning they are unique and cannot be interchanged in the way that one dollar bill is identical to another dollar bill or two bitcoins are interchangeable. NBA Top Shot releases moments in various tiers of scarcity: Common (1,000+), Rare (150-999), or Legendary (25-99), as well as the auction-only Platinum Ice Ultimate Tier (only 3) and the Genesis Ultimate Tier (only 1). Special edition series and collectible challenges also drive up value, as do desirable serial numbers of moments (lower serial numbers and serial numbers that match the player’s jersey number are the highest demand).

Unlike trading cards, NBA Top Shot moments are available globally in real-time, expanding the market size. Also, unlike trading cards, there is no need for a third-party to evaluate if the moment is in mint condition, no concern over the quality diminishing over time, and no need to transport it to a new buyer, making for an extremely efficient marketplace.

What’s next for NBA Top Shot?

Regardless of whether the popularity of NBA Top Shot is based on speculation of investors or if it is a driver for fan growth and engagement, the NBA will come out as a winner. Unlike traditional trading card licensing deals, the NBA Top Shot takes a 5% fee for all transactions on its marketplace meaning both Dapper Labs and the NBA profit on the appreciation of moments on secondary market. With over $100M in sales since launching in October, that could mean $2.5M for the league even if the NBA only gets half of that 5% fee.

While that may not sound like a game changing number, the value is rising with each passing day. According to Crypto Slam, (as of 2/24/21) NBA Top Shot has had over $18M in sales over the past 24 hours, potentially netting the NBA over $450,000 in a single day. With such potential, it is only a matter of time before other leagues and sports properties start jumping on board with their own versions of Top Shot.